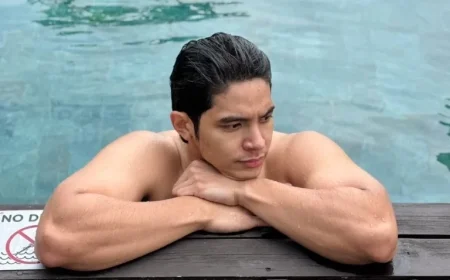

Alek Manoah Signs with Angels on One-Year Deal: Terms, Role, and What It Means for His Comeback

Right-hander Alek Manoah has a new home in Anaheim. The former All-Star agreed to a one-year, $1.95 million major-league contract on Tuesday, a fully guaranteed deal that gives the Angels a buy-low shot at upside while offering Manoah a clean runway to reboot his career.

Contract details and roster mechanics

-

Length/guarantee: 1 year, $1.95 million on the 40-man roster.

-

Status: Immediate big-league deal; no minor-league spring invite needed.

-

Context: Manoah became a free agent after being non-tendered last month, following a late-season waiver move that briefly sent him to Atlanta.

The number sits just under the lower range for established arbitration-eligible starters, reflecting both his past peak and recent volatility.

Why the Angels make sense for Alek Manoah

Anaheim needed rotation depth with ceiling—not just innings. At his best, Manoah brings power sink/ride up in the zone, a tight slider that misses barrels, and competitive edge that once produced a top-three Cy Young finish. The Angels’ bet is simple: if the delivery syncs and fastball life returns, they’ve added a mid-rotation starter at a fraction of market cost.

Immediate fit highlights:

-

Role: Compete for a rotation spot in spring; worst case, swingman with multi-inning value.

-

Ballpark/defense: A spacious home outfield and improving run prevention can soften contact risk while he rebuilds consistency.

-

Coaching lens: Emphasis on fastball shape and strike efficiency should headline his spring plan.

Where Manoah’s comeback stands

Manoah’s trajectory has zigzagged since his 2022 breakout season. An elbow surgery in June 2024 sidelined him for much of that year and delayed his 2025 impact. He returned to action on a measured workload and finished the season with limited innings as he worked back to form. The late-year roster churn—designated for assignment, claimed, then non-tendered—was procedural as much as performance-based, setting the stage for today’s fresh start.

Key checkpoints for 2026:

-

Velocity band: Is the four-seamer back in the 94–96 mph window with carry?

-

Slider bite/command: The pitch is his separator when it lands glove-side with late tilt.

-

Strike rate: Post-injury recoveries often stabilize first in zone% and first-pitch strikes before whiff rates fully rebound.

What the Angels are buying—and the risk

Upside: A credible path back to 150+ innings with league-average or better results if the arsenal ticks up even modestly from last summer’s baseline. Manoah’s competitive makeup and track record against tough lineups suggest the ceiling is higher than a typical one-year flyer.

Risk: Command wobble and fastball shape that drifts to the heart of the plate can lead to home-run clusters. If the slider backs up or the elbow workload management demands extra rest, depth will be tested early.

Early projection and rotation impact

A realistic Year 1 expectation if health cooperates:

-

IP: 140–165

-

ERA: 3.80–4.20

-

K% / BB%: ~24–26% / 7–9%

-

Role: No. 3/4 starter with stretches of higher-end performance when fastball/slider tunneling clicks

For the Angels, this move raises the floor of the middle rotation tiers and reduces pressure on younger arms. It also keeps budget flexibility for a bullpen add or another mid-rotation swing if the market breaks right later in the winter.

The big-picture bet

Manoah’s arc—from meteoric rise to elbow rehab to roster shuffle—has been anything but linear. This one-year pact aligns incentives perfectly: the club gets optionality and upside, and the pitcher gets a platform to re-prove durability and stuff ahead of another trip through free agency next offseason. If the spring data shows his heater riding again and the slider regaining depth, this could be one of the winter’s savviest low-cost bets.