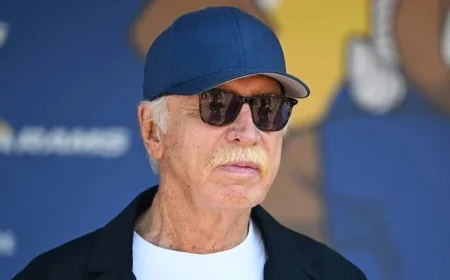

Michael Saylor Battles to Prevent $8 Billion Bitcoin Collapse

Billionaire Michael Saylor is currently navigating a challenging situation with his company, Strategy, which is a significant holder of Bitcoin. The firm owns more than 3% of the world’s Bitcoin supply, but its stock has seen a dramatic decline.

Challenges Faced by Strategy

The cryptocurrency market has been bearish, and forthcoming regulatory changes threaten to trigger a mass selloff of Strategy’s shares. Recently, the company announced a reserve fund of $1.2 billion to address upcoming interest and dividend payments, yet this effort has not stabilized its stock price.

- Strategy’s stock is down approximately 50% since October 1.

- As of now, the company’s mNAV has fallen below one, indicating a significant loss in market value.

- On October 10, MSCI proposed a rule set to take effect in February, which could lead to a large selloff of Strategy shares amounting to over $8 billion.

Criticism and Defense

Critics have raised concerns about Strategy’s business model, describing it as potentially unsustainable. This model relies on selling stock to fund its Bitcoin purchases, leading some to label it as a Ponzi scheme. However, Saylor’s supporters argue that these critiques come from individuals who fail to grasp the fundamentals of cryptocurrencies and corporate finance.

The Stakes of Bitcoin Holdings

With Bitcoin’s value significant to its business model, any move by Strategy to sell a portion of its holdings could adversely affect market confidence. The broader implications are concerning, as it could lead to a large-scale downturn affecting other companies following a similar business model.

Recent Developments

In November, Strategy increased its Bitcoin holdings, bringing its total to approximately 650,000 Bitcoin, valued at around $58.5 billion at recent prices. Despite aggressive acquisition strategies, the company has accumulated liabilities, including $200 million due in dividends by the end of December.

- Average purchase price of Bitcoin by Strategy: $74,436.

- Total spent on Bitcoin, including fees: approximately $48.4 billion.

Future Actions and Market Implications

As a response to increasing financial strain, Saylor announced a dollar reserve fund of $1.4 billion to manage future dividend obligations. However, during a recent podcast, the CEO indicated that selling some Bitcoin may be a necessary decision if the company’s mNAV remains below one for an extended period.

Market Outlook

The current scenario has drawn sharp criticism from notable figures urging caution against Strategy. If forced to liquidate, the ripple effect could deeply impact the cryptocurrency market, leading to significant declines in Bitcoin’s value.

Despite these challenges, some industry observers believe that Saylor’s innovative approach to cryptocurrency and corporate finance might establish Strategy as a long-term leader in the digital asset sector.

As volatility in the crypto market continues, the coming months will be crucial in determining whether Strategy will maintain its pioneering status or succumb to market pressures.