Kalshi and Luana Lopes Lara: valuation surge crowns a 29-year-old as the youngest self-made woman billionaire

A fresh funding milestone has pushed Kalshi into the top tier of fintech valuations and propelled its co-founder, Luana Lopes Lara, into the record books. At just 29, the Brazil-born entrepreneur is now widely cited as the world’s youngest self-made woman billionaire, as investors assign Kalshi an eleven-figure valuation and bet big on regulated prediction markets becoming a mainstream asset class.

Who is Luana Lopes Lara, and how she steered Kalshi’s rise

Luana Lopes Lara took an unconventional route to the trading floor. Trained as a ballerina before pivoting to engineering and entrepreneurship, she co-founded Kalshi in 2018 with a simple but audacious idea: create an exchange where people can trade the outcomes of real-world events—everything from inflation prints to entertainment releases—within a fully regulated framework. That premise demanded years of licensing work and market education. The payoff arrived in waves: regulatory green lights, accelerating volumes, and now a valuation jump that places both founders in the ten-digit wealth club on paper.

Lopes Lara’s leadership style blends product obsession with regulatory fluency. Insiders point to a two-track focus—meticulous contract design (so markets resolve cleanly) and a friction-light onboarding funnel (so newcomers can trade confidently). The result is an exchange that behaves like a modern brokerage app on the surface but clears and settles like a traditional market under the hood.

What Kalshi actually lets you trade—and why that matters

Kalshi lists “event contracts” that settle to Yes/No outcomes. Each contract is quoted from $0.01 to $0.99, mapping directly to an implied probability. If the event happens, Yes settles at $1; if not, No does. That simple payoff turns public curiosity into priced expectations—and gives analysts, fans, and hedgers a way to express views or offset risk around scheduled data and news cycles.

Popular categories right now include:

-

Macro and policy: CPI month-over-month thresholds, jobs figures, rate paths.

-

Elections and governance: where permitted under current rules and litigation outcomes.

-

Corporate and culture: product announcements, award shows, content drops tied to fixed calendars.

-

Sports-adjacent calendars: date-driven markets around marquee events.

The appeal isn’t just speculation. Corporates can hedge exposure to releases that move demand; individuals can calibrate risk around binary calendar events; journalists and analysts can benchmark their priors against live, money-backed probabilities.

Why investors value Kalshi so highly right now

Three forces underpin the new valuation:

-

Regulatory moat. Securing and defending permissions to list event contracts created a barrier to entry. That foundation lets Kalshi scale categories methodically while competitors face longer compliance runways.

-

Distribution flywheel. As volumes grow, tighter spreads and deeper books attract more traders; better liquidity then supports more nuanced markets, which in turn draw broader audiences.

-

Data gravity. Live trading odds are now a content product in their own right. Media, newsletters, and dashboards increasingly embed probabilities alongside headlines, giving Kalshi a second lane of relevance beyond pure trading fees.

The legal landscape: guardrails, not a free-for-all

Event markets live at the intersection of finance, policy, and consumer protection. Kalshi operates under commodity-exchange rules that impose strict listing standards and surveillance. Some categories—especially politics—can swing with court rulings and agency interpretations. In recent days the operating environment remains active: certain permissions have advanced, others face fresh challenges, and appeals continue. The upshot for users is simple: listings may expand or contract as decisions land, but the exchange framework is designed to keep resolution criteria transparent and enforceable. Where outcomes are uncertain, the company has tended to pause or adjust markets rather than overextend.

Luana Lopes Lara’s next chapter: growth without drift

The billionaire headline is eye-catching; the harder task lies ahead. Two execution priorities will likely define Lopes Lara’s 2026 roadmap:

-

Category depth over sprawl. Expect more tradable strikes around core macro releases and seasonality-driven events, plus standardized calendars that repeat monthly or annually. This builds habit and liquidity density, the lifeblood of any exchange.

-

Institutional bridges. As data feeds and APIs harden, more desks will treat event probabilities as inputs to research and risk systems. That expands utility without compromising consumer UX.

Kalshi, media visibility, and the normalization of predictive odds

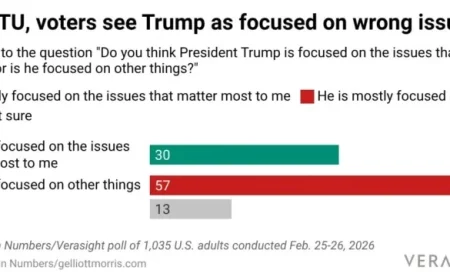

Kalshi’s probabilities have begun showing up in mainstream contexts—tickers, graphics, and explainers that sit alongside conventional polls and analyst forecasts. Recent integrations underscore a broader shift: audiences now expect a “market view” on the same screen as news summaries. That feedback loop helps demystify event trading for casual users while giving professionals a real-time consensus to test against.

What to watch next for Kalshi and Luana Lopes Lara

-

Quarterly volume run-rates. Sustained double-digit month-over-month growth would justify the step-up valuation.

-

Resolution track record. Clean, timely settlements keep trust high and reduce regulatory friction.

-

Rulemaking and court outcomes. Any clarifications around political and sports-adjacent markets could reshape the product roadmap quickly.

-

Global footprints. Partnerships and localized listings may open additional, compliant geographies.

The new funding milestone doesn’t just mint a headline-making fortune for Luana Lopes Lara; it validates Kalshi’s core bet that regulated prediction markets belong in everyday finance and media. If the company can keep deepening liquidity, navigating legal guardrails, and turning probabilities into a ubiquitous data layer, the latest valuation may prove less a peak than a starting gun.