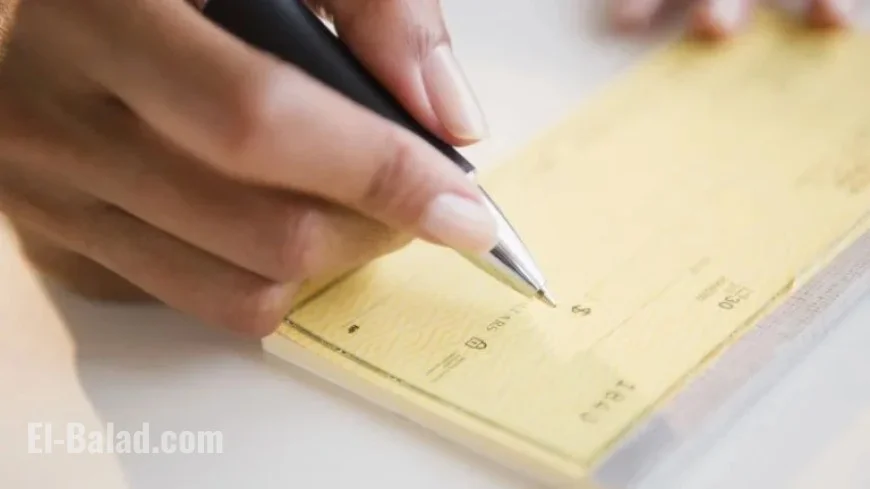

Are Paper Checks Facing Obsolescence Like the Penny?

The recent discontinuation of penny production by the US Mint has sparked discussions about the future of paper checks. With this shift, questions arise whether paper checks are on the path to obsolescence, similar to the penny.

Federal Changes in Payments

As of the end of September, the government has ceased sending out most paper checks. This move is part of an initiative to modernize federal benefits payments. Additionally, the Federal Reserve has indicated it may reconsider its check processing services for banks.

Proposed Changes from the Federal Reserve

- The Federal Reserve is weighing options to wind down its check services.

- It may also invest in check processing, which would incur higher costs.

- Failure to invest could lead to decreased service reliability.

The Fed’s notice highlighted a decline in check use, which has coincided with the rise of digital payment methods. Fraud rates associated with checks have also increased, raising concerns about their future viability.

Consumer Preferences and Trends

A June report from the Federal Reserve Bank of Atlanta revealed significant consumer sentiment regarding payment methods:

- Over 90% of consumers prefer alternatives to checks for bill payments.

- Only 6% of bills were paid by check last year, down from 18% in 2017.

- Checks are viewed as less convenient and the least secure payment method, apart from cash.

The Role of Checks in the Payment System

Despite the trends towards digital payments, paper checks still account for about 5% of all transactions, representing 21% of the total payment value. Michelle Bowman, Vice Chair for Supervision at the Federal Reserve, emphasized checks’ continued relevance for consumers and businesses.

The Historical Context of Paper Checks

The history of checks stretches back nearly 2,400 years, gaining traction in the 1500s in Amsterdam. As people began depositing cash for safekeeping, this system evolved into the checks we recognize today.

Impact on Vulnerable Populations

Eliminating paper checks could adversely affect consumers without traditional banking access. A 2024 report indicated approximately 6% of adults are “unbanked,” with that percentage rising to 22% for those earning less than $25,000.

Older individuals and those without smartphones may struggle to adapt to a fully electronic payment landscape. Checks remain a crucial payment method for certain merchants, often saving them from high credit card transaction fees.

Challenges in Transitioning Away from Checks

Doug Kantor from the National Association of Convenience Stores warned about the unintended consequences of winding down check services. He highlighted that many consumers still use checks, often unknowingly, through automated bank payments.

Although checks are less common now, they still play a vital role in the financial ecosystem. The potential elimination of checks raises questions about access and inclusivity in the evolving payment landscape.