US Debt Crisis: Severe Austerity Looms After Fiscal Calamity

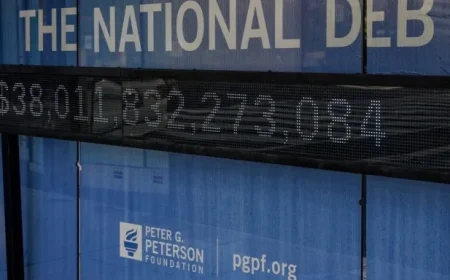

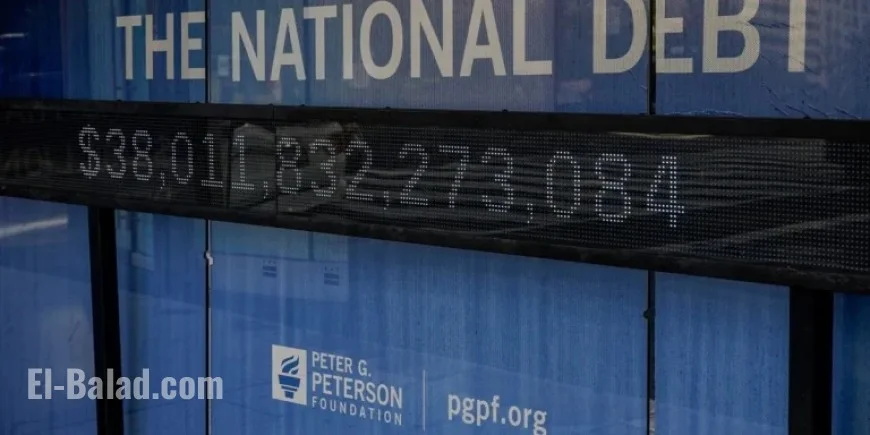

The U.S. is approaching a critical phase regarding its national debt, leading to severe austerity measures. Harvard professor Jeffrey Frankel has highlighted the urgency of addressing the unsustainable growth of publicly held debt, which currently stands at 99% of GDP and could soar to 107% by 2029.

Current Debt Situation

The federal debt service costs over $11 billion each week, consuming 15% of federal spending in the current fiscal year. This trend raises concerns about the sustainability of U.S. fiscal policies.

Potential Solutions and Their Viability

Frankel outlined several potential solutions to manage the debt crisis:

- Faster economic growth

- Lower interest rates

- Default

- Inflation

- Financial repression

- Fiscal austerity

While economic growth is the most favorable option, it appears unlikely due to a shrinking labor force. Despite advancements in artificial intelligence boosting productivity, it may not suffice to curb the debt.

Challenges with Alternatives

Frankel dismissed the return of historically low-interest rates and the plausibility of a default on Treasury bonds. He highlighted the adverse implications of relying on inflation as a means to reduce debt, equating it to a default scenario. Financial repression, where banks are coerced into purchasing bonds at lower yields, presents its own set of complications.

The Austerity Outlook

Frankel posited that severe fiscal austerity remains the most likely outcome. He indicated that achieving a sustainable debt trajectory could necessitate significant cuts to defense spending or virtually all non-defense discretionary programs.

Political dynamics complicate potential reforms, with Democrats unlikely to make significant spending cuts and Republicans potentially leveraging any fiscal flexibility to advocate for tax reductions.

Implications and Future Outlook

Looking ahead, Frankel warned that any implementing austerity is likely to occur only post severe fiscal crises, suggesting that delays in addressing these issues may require more drastic measures. This forecast aligns with insights from Oxford Economics, which predicts that insolvency in the Social Security and Medicare trust funds by 2034 could catalyze reform.

Lawmakers may initially prefer to enable these programs to draw from general revenue. However, negative fiscal developments could lead to a swift reevaluation of policies, introducing significant changes to Treasury bond demand.

Analysts expect that a radical shift in the bond market could compel Congress to reconsider necessary reforms, highlighting the urgency of addressing the growing national debt.