Paramount’s Warner Bros. Discovery Deal Falters: What Went Wrong?

In the world of entertainment, unexpected twists can reshape the landscape rapidly. Recently, the ambitious plans of Oracle founder Larry Ellison and his son David to acquire Warner Bros. Discovery have faced significant setbacks.

Background of the Deal

Just months ago, Larry Ellison financed an $8 billion acquisition of Paramount Pictures led by David Ellison, now the CEO of Paramount Skydance. Riding high on this successful acquisition, the Ellisons sought to expand their influence by bidding at least $60 billion for Warner Bros. Discovery.

Why Paramount’s Bid Faltered

Initially, the Paramount bid appeared strong. They were backed by a prominent billionaire, and even had support from political figures. However, a sudden development turned the tide.

- Netflix announced its own acquisition deal for Warner Bros. Discovery valued at $82.7 billion.

- This announcement included a purchase price of $27.75 per share.

- Warner’s board opted for the Netflix offer, viewing it as more favorable for shareholders.

The announcement surprised many in the industry who initially assumed that Paramount had the upper hand. Analysts indicated multiple factors contributed to the outcome, including Paramount’s earlier low bids that were rejected and perceived overconfidence in their ability to win.

Critique of Paramount’s Strategy

Paramount submitted a series of unsolicited bids starting at $19 per share, which were all rejected. Frustration grew among Warner’s executives, who felt Paramount was dismissive of their concerns.

Furthermore, as the negotiations heightened, Paramount sought additional funds, turning to private equity firm Apollo Global Management. This move raised questions about their commitment and financial stability, especially as Oracle’s stock values fluctuated.

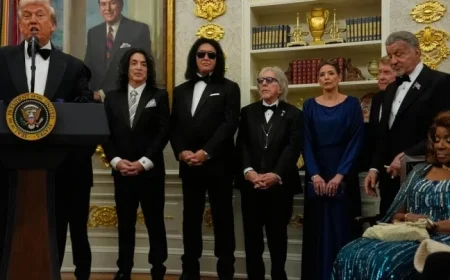

Industry insiders noted that Larry Ellison’s ties to political figures also added complexity. His prominent support for Donald Trump and controversial corporate decisions may have dampened enthusiasm for the Paramount bid within some regulatory circles.

Legal Implications and Future Steps

In light of these developments, Paramount is reportedly preparing for legal action against Warner Bros. Discovery, alleging that the auction process favored Netflix. Their teams plan to urge investigations into potential antitrust violations.

Paramount’s executives issued statements declaring concerns about the fairness of the bidding process. They have submitted multiple offers, with the final being $30 per share, but none managed to outpace Netflix’s proposal.

Market Reaction and Outlook

As Netflix anticipates a lengthy approval process lasting up to 18 months for its acquisition, questions remain about the feasibility of their deal. Paramount’s leadership now faces scrutiny and pressure to recalibrate their strategies moving forward.

While the push for Warner Bros. Discovery may have faltered, Larry Ellison’s past suggests he is still a formidable player in the entertainment industry. The next moves could determine not just the fate of Paramount but the competitive dynamics of Hollywood as a whole.