Gold Prices Dip Slightly Amid Silver’s Approach to $60

Gold prices experienced a slight dip recently, while silver hovered near the significant milestone of $60. The current gold/silver ratio stands at 71.9, which is the lowest observed since early August 2021. This development highlights the ongoing dynamics in the precious metals market.

Gold and Silver Market Overview

As of the latest trading data, gold settled at $4,228 per ounce, while silver reached $58.80. This brings silver close to its all-time high of $59.90. Year-to-date, silver’s impressive growth exceeds 104.5%, while gold has recorded a gain of 66.6%.

Current Ratio and Fair Values

The gold/silver ratio’s mean currently sits at 69.4. Utilizing this ratio, we can calculate the fair value for silver. The formula is as follows:

- Gold Fair Value (GFV): $3,890

- Gold/Silver Ratio Mean (GSM): 69.4

- Silver Fair Value (SFV): GFV ÷ GSM = $56.05

This indicates that silver is presently overvalued by 4.9% based on the calculated fair value. However, if we base it on the current gold price, silver could be undervalued by 3.5%, suggesting potential further upward movement towards $60.

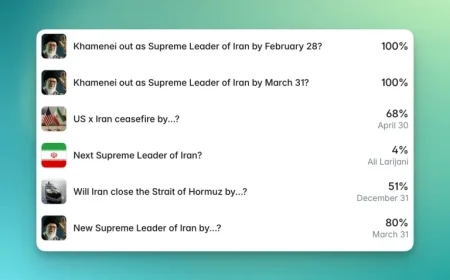

Market Predictions and Economic Factors

The Federal Open Market Committee’s upcoming policy statement on interest rates could significantly impact the prices of both gold and silver. As inflation remains above the target range, opinions on rate adjustments are divided among policymakers. Recent job market data also adds complexity to these dynamics.

| Commodity | Current Price | Change (%) |

|---|---|---|

| Gold | $4,228 | -0.7% |

| Silver | $58.80 | +3.0% |

As both metals approach significant thresholds, market participants are closely monitoring these developments. Silver appears well-positioned to potentially surpass the $60 mark, particularly if favorable monetary policy decisions are made.