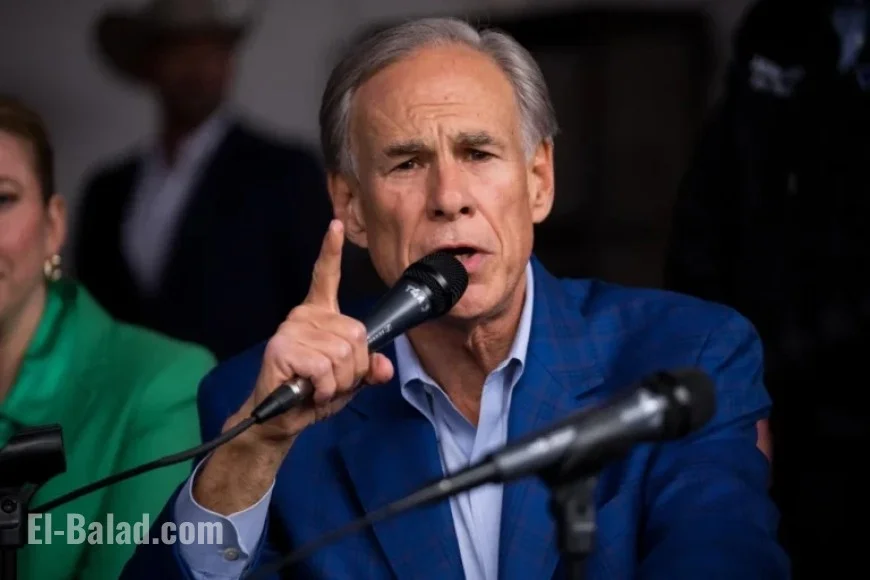

Can Abbott’s Property Tax Plan for Schools Succeed?

Texas Governor Greg Abbott has launched a significant reelection campaign focused on lowering property taxes for homeowners. His property tax plan, which aims to reshape the financial landscape for Texas residents, targets school property taxes, limits on local tax increases, and seeks to support homeowners amid rising property values. Abbott, a three-term governor, made his announcement in Fort Worth and emphasized the need for substantial tax reform.

Key Features of Abbott’s Property Tax Plan

- Elimination of school property taxes for homeowners.

- Tighter restrictions on the local governments’ ability to raise taxes.

- Prohibition of sales tax hikes as a funding mechanism for property tax cuts.

The governor expressed that property taxes have been a growing concern for Texans. He stated, “Every single year, you, my constituents, keep saying our property taxes are too high.” This sentiment has driven Abbott’s agenda to initiate a larger dialogue on how to address these financial burdens.

Support and Skepticism Surrounding the Plan

Abbott’s proposals have garnered support from conservative groups such as the Texas Public Policy Foundation. James Quintero, a policy director at the foundation, praised the plan for potentially enhancing affordability and predictability in the tax system.

However, some economists and tax policy experts express skepticism. Adam Langley from the Lincoln Institute of Land Policy characterized Abbott’s proposal as impractical, arguing that it fails to address the complexities of Texas’s tax system.

The Financial Implications

Eliminating school property taxes poses significant financial challenges. According to the Legislative Budget Board, the cost of replacing these taxes would be approximately $39.5 billion for the tax year 2023 alone. In 2024, school districts collected around $42 billion from property taxes.

Historically, property tax reliance in Texas has been high due to a lack of a state income tax. Cutting these taxes while maintaining essential public services remains a balancing act that previous legislation has failed to achieve.

Looking Ahead

Abbott has proposed a constitutional amendment that would allow voters to decide on the elimination of school property taxes. This measure, if passed, would create long-term implications for Texas’s budget and education funding.

The governor is optimistic that the state’s growth will sustain the financial ability to support these reforms. However, experts warn that economic downturns could jeopardize funding for education and public services, raising questions about the sustainability of Abbott’s ambitious plan.

As the 2026 election approaches, Texans are left to consider the feasibility of Abbott’s property tax plan and its potential impact on their financial futures.