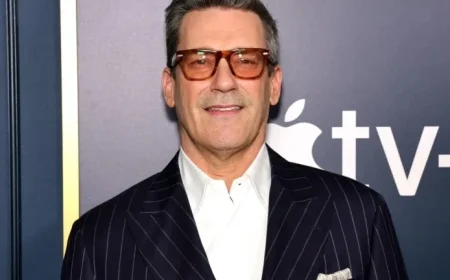

David Ellison Appeals Directly to WBD Shareholders in Formal Letter

David Ellison has turned his attention to Warner Bros. Discovery (WBD) shareholders. He believes his company, Paramount Skydance, is the better choice for a takeover compared to Netflix. On Wednesday, he reached out to WBD stockholders with a detailed letter underscoring his case.

Ellison’s Appeal to WBD Shareholders

In his letter, Ellison encouraged investors to “tender their shares today.” This request invites WBD shareholders to express their willingness to sell their shares to Paramount Skydance. His current offer stands at $30 per share, cash only. This proposal marks Ellison’s seventh attempt to acquire WBD.

Comparing Offers

Ellison argues that his offer is a “superior value” compared to Netflix’s accepted bid of $23.25 per share. Netflix’s deal also includes $4.50 in stock and one share in WBD’s Global Networks spinoff company. However, Ellison maintains that this total value is “materially lower than advertised,” suggesting that Netflix’s assets are valued at $82.7 billion.

- Ellison’s Offer: $30 per share (cash)

- Netflix’s Offer: $23.25 per share, $4.50 in stock, plus one share in WBD’s Global Networks

Regulatory Considerations

Ellison believes the acquisition process would face fewer obstacles if led by Paramount. He points out that the Netflix deal is likely to encounter regulatory challenges, particularly in Europe. The Digital Services Act and the Digital Markets Act aim to scrutinize major tech companies for potential monopolistic behavior.

Ellison’s Assurance and Criticism

In his letter, Ellison emphasizes that Paramount’s proposal offers “superior value” and a more straightforward path to completion than Netflix’s arrangement. He stated that it is still “not too late to realize the benefits of Paramount’s proposal” for WBD shareholders if they act promptly.

Ellison also addressed rumors about his company’s financial reliability. He called claims suggesting that Paramount might not be able to fulfill its obligations “absurd.” He criticized WBD and its advisors for failing to communicate or respond to his previous offers, stating that he was left on “Read” by WBD CEO David Zaslav.