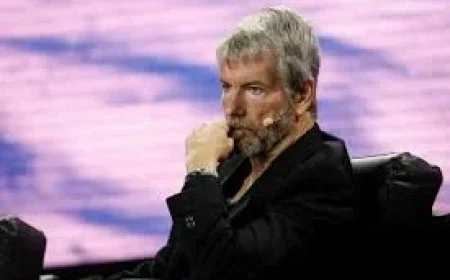

Fed Chair Powell Confronts Rising Opposition to December 2025 Rate Cuts

Federal Reserve Chair Jerome Powell addressed growing dissent regarding the central bank’s recent interest rate cut. On Wednesday, a decision was made to decrease rates by a quarter percentage point. This move has sparked internal conflict among Federal Reserve officials.

Division Within the Federal Reserve

Despite Powell’s assurances, the details from the recent Federal Open Market Committee (FOMC) meeting indicate significant opposition. While only a few members of the committee voted against the decision, many regional Federal Reserve bank presidents expressed dissent.

Key Details from the Meeting

The dissenting opinions come from both voting and non-voting members. The divide reflects a broader concern about the implications of rate cuts:

- Rate Cut Impact: The quarter percentage point cut aims to stimulate economic growth.

- Opposition Voices: Several regional bank presidents voiced concerns about the timing and necessity of the cut.

- Economic Indicators: Mixed economic data has fueled debate over future monetary policy.

As Federal Reserve officials continue to navigate a complex economic landscape, the opposition to December 2025 rate cuts is likely to intensify. Powell and his team face the challenge of balancing growth with inflation control, a task that may require careful consideration of dissenting views going forward.

Looking Ahead

The Federal Reserve’s approach to monetary policy will remain under scrutiny. How Powell addresses the internal divisions and external economic pressures will be critical in shaping future decisions.