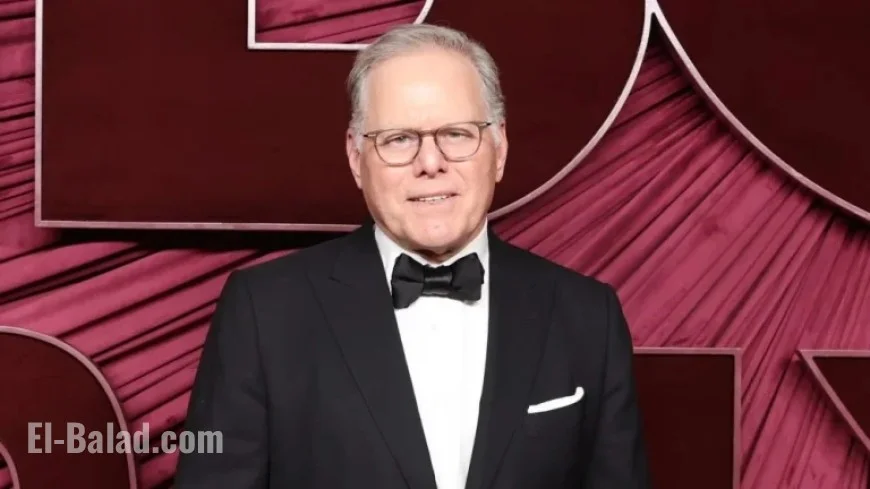

Warner Bros. Sale May Propel David Zaslav to Billionaire Status

David Zaslav, the current president and CEO of Warner Bros. Discovery, faces a potentially transformative moment as rumors swirl about significant acquisition offers from major companies like Netflix and Paramount Skydance. Should a deal materialize, Zaslav could emerge as a billionaire due to massive payouts tied to his stockholdings and other compensation agreements.

Warner Bros. Discovery Sale Possibilities

Recent reports indicate that Zaslav’s stock and future grants could reach approximately $660 million if the anticipated sale to Netflix goes through in the next 12 to 18 months. Bloomberg’s analysis suggests that this would elevate Zaslav’s overall net worth to exceed $1 billion.

Comparative Offers from Netflix and Paramount

Netflix’s proposal estimates a price of $27.75 per share specifically for Warner Bros. studios and HBO Max. Meanwhile, Paramount Skydance has submitted a more competitive bid of $30 per share, which could dramatically increase Zaslav’s financial gain should their offer succeed.

- Netflix Offer: $27.75/share for Warner Bros. studios and HBO Max

- Paramount Offer: $30/share for all of Warner Bros. Discovery

Zaslav’s Compensation and Financial Landscape

As one of the highest-paid executives in the media sector, Zaslav’s compensation package increased by 4.4% in 2024, amounting to $51.9 million. This includes a cash bonus of $23.9 million and $23.1 million in performance-based stock grants, despite Warner Bros. Discovery reporting an $11.5 billion financial loss for that year.

His previous compensation in 2021 reached an astounding $246.6 million, bolstered by stock options valued at $203 million at that time. This high paycheck was largely justified by Zaslav’s role in acquiring WarnerMedia from AT&T, a transition that commenced in May 2021 and finalized in April 2022.

Implications of Shareholder Sentiment

In June 2025, a majority of shareholders at Warner Bros. Discovery expressed dissatisfaction with Zaslav’s pay package, resulting in a non-binding vote against it. This sentiment prompted the company to renegotiate Zaslav’s employment agreement, emphasizing a shift towards long-term incentives and a reduction in annual cash compensation as part of a strategic realignment for the company’s future.

Future Perspectives on M&A Dynamics

The competitive landscape of mergers and acquisitions involving Warner Bros. Discovery is still evolving. The potential for Paramount’s David Ellison to increase his hostile takeover bid remains, especially as he asserts his offer is not final. This ongoing battle places Zaslav in a pivotal position as he works towards securing a favorable outcome for the company.

Ultimately, Zaslav’s leadership during this crucial period will not only impact his financial standing but also the future structure of Warner Bros. Discovery amid a changing media industry. Whether through a partnership with Netflix or a takeover by Paramount, Zaslav stands to significantly benefit from the outcome.