Warner Bros. Acquisition by Netflix or Paramount Reignites Entertainment Oligopolies

The recent bid by Netflix to acquire Warner Bros. for $83 billion has sparked significant discussions in the entertainment industry. This deal, if successful, marks a potential shift in power dynamics, indicating that technology firms are increasingly dominating the media landscape.

Impact of Netflix’s Acquisition of Warner Bros.

David Zaslav, CEO of Warner Bros. Discovery, has emphasized that such a deal reflects a major generational change, suggesting the traditional Hollywood rules are evolving. This situation raises important questions about the future of content creation and distribution.

The Evolution of Hollywood’s Oligopoly

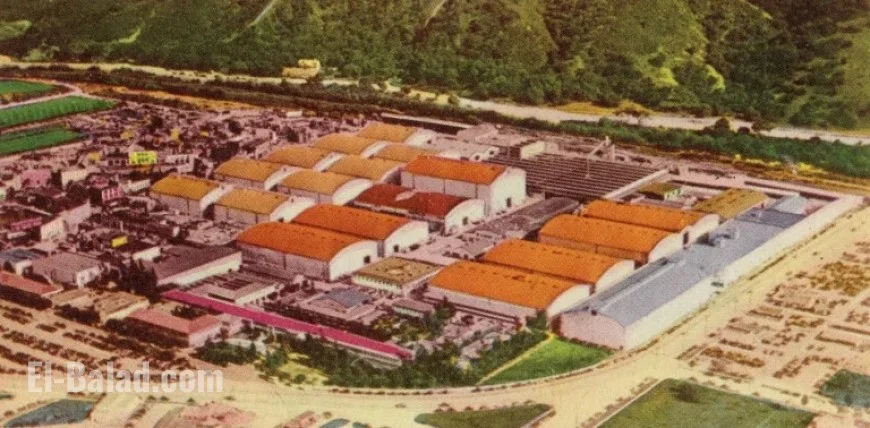

The entertainment industry has a long history of oligopolistic structures. In the 1920s, key players like Adolf Zukor championed vertical integration in Hollywood. His strategy involved merging production companies, distribution channels, and theater chains into single corporate entities. This model allowed studios to control the entire process from conception to exhibition.

- Adolf Zukor established a dominant film studio model.

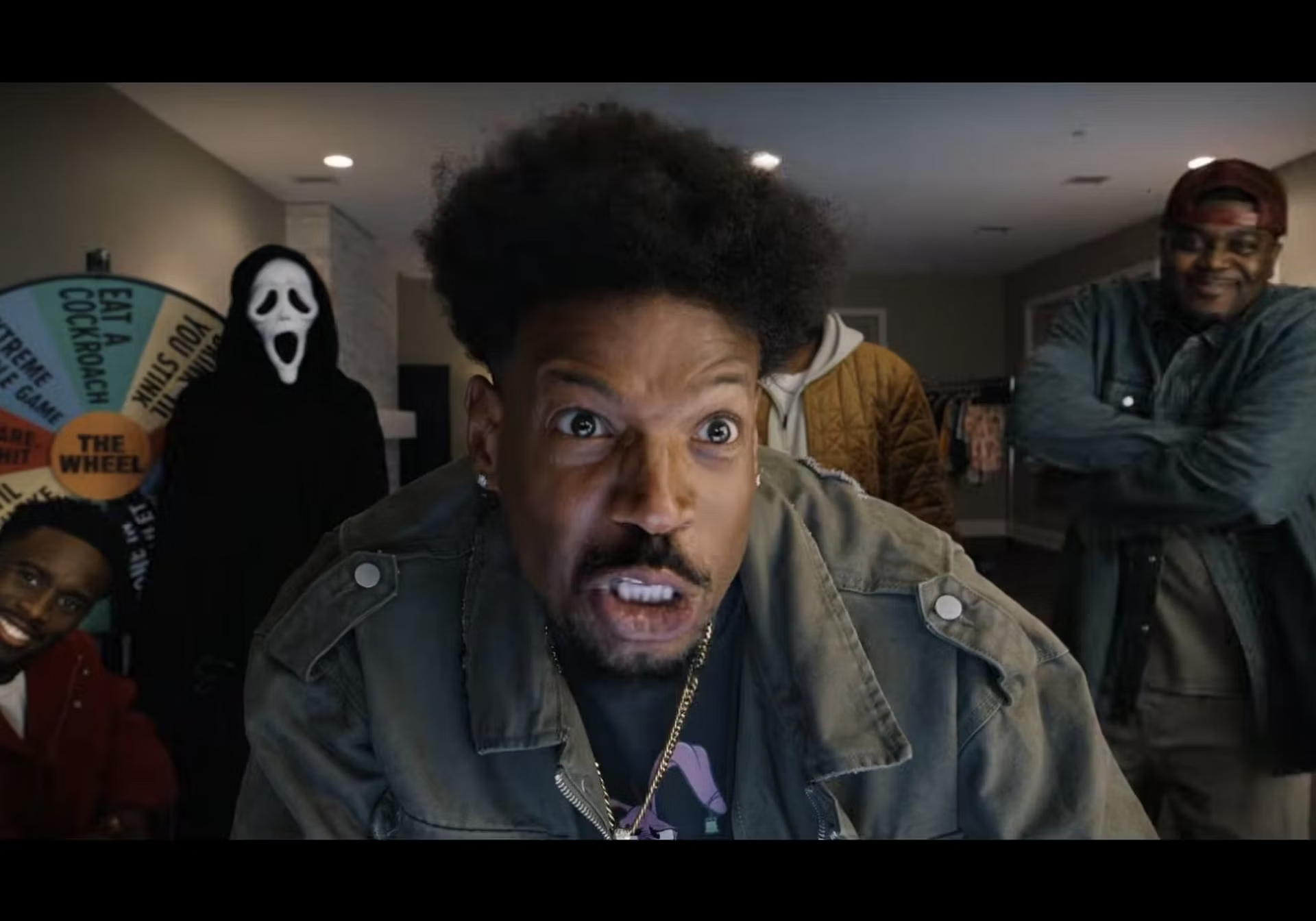

- The Warner brothers also followed similar paths, merging with various entities to expand their reach.

- Metro-Goldwyn-Mayer (MGM) dominated the market with vast revenues and a roster of major stars.

By the mid-20th century, various studios, including MGM, Warner Bros., and Paramount, controlled a significant portion of the industry, functioning effectively as an oligopoly that dictated film production and distribution.

Regulatory Changes and Industry Response

In 1948, a pivotal Supreme Court decision dismantled this hold through the Paramount Decision. This ruling mandated studios to divest from ownership of theaters, which allowed independent filmmakers more freedom and paved the way for diverse storytelling.

Despite the challenges of the 2020s, the streaming model, pioneered by Netflix, presented an opportunity for innovative filmmaking. Directed by the limitations of traditional distribution, filmmakers began to flourish outside the constraints of large studios.

Challenges Facing Warner Bros. Discovery

Following the acquisition of Time Warner by AT&T in 2018, Warner Bros. faced numerous challenges, especially during the COVID-19 pandemic, which severely impacted theatrical releases. The merger of HBO and WarnerMedia to create Warner Bros. Discovery did not yield the expected results, as the confusion around branding and content offerings disappointed consumers.

- Warner Bros. Discovery is the third-largest streaming service, following Netflix and Disney+.

- Plans for a new bundled service named Max faced backlash, leading to rebranding back to HBO Max.

- Company strategies have resulted in the cancellation of numerous projects and a decline in original programming.

The Future of Content Creation

As the potential merger between Netflix and Warner Bros. looms, critics warn that it may diminish the creative space for filmmakers and lead to higher subscription costs for viewers. If Netflix acquires Warner Bros., it could further solidify its control over content by limiting choices while raising prices for its subscriber base.

Regulatory Concerns and Market Dynamics

The Department of Justice previously expressed concerns regarding monopoly practices in the entertainment sector, especially under the Trump administration. Any future consolidation could exacerbate existing issues, especially with the rise of artificial intelligence in creative fields.

In summary, the proposed Netflix acquisition of Warner Bros. could signal a reemergence of an oligopolistic entertainment landscape where few corporations hold significant control over film production and distribution. Observers warn that this trend may lead to reduced diversity in storytelling and higher costs for consumers.