SpaceX Executive Announces Interest in IPO Launch

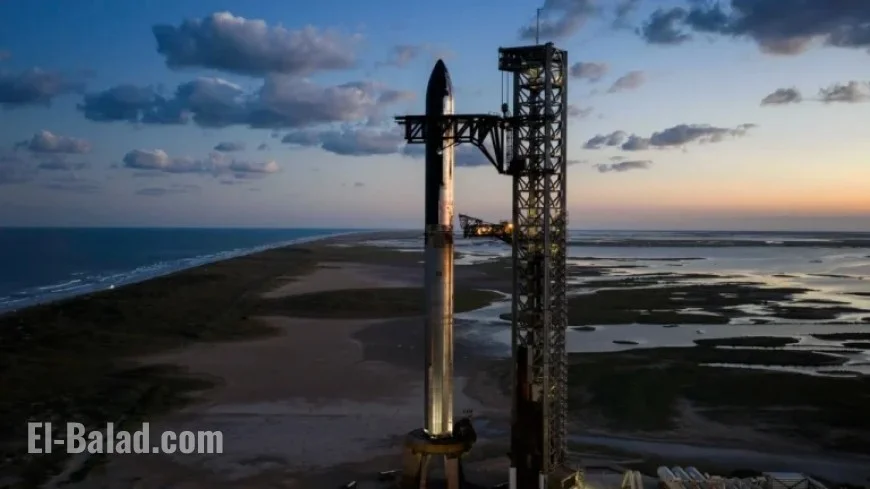

SpaceX’s chief financial officer, Bret Johnsen, has indicated that the company is contemplating an initial public offering (IPO) as early as next year. This move is aimed at generating funds for ambitious lunar and Mars missions, alongside the development of orbital data centers. John’s announcement, communicated to employees on December 12, highlights the potential capital influx that could bolster SpaceX’s operations.

IPO Plans and Financial Context

According to internal sources, whether and when this IPO would materialize remains “highly uncertain.” The speculation regarding SpaceX’s IPO has been fueled by the company’s stature as one of the world’s most valuable private enterprises. An IPO could potentially raise tens of billions of dollars, facilitating a massive scaling effort for the Starship program and other projects.

Funding Future Projects

- Significant capital could enable accelerated Starship launch rates.

- Funding could also support the deployment of artificial intelligence (AI) data centers in space.

- Plans include the construction of Moonbase Alpha and crewed missions to Mars.

Johnsen emphasized in his message that public offerings like this one are crucial for future developments. The recent focus on establishing orbital data centers aligns with the growing demand for AI computing capabilities. Elon Musk has expressed his vision for integrating localized AI computing through satellites linked with SpaceX’s Starlink broadband constellation.

Investors and Market Impact

Market interest around the potential IPO is palpable. Analysts like Andrew Chanin from ProcureAM have noted that investors are eager for access to SpaceX’s stock. Currently valued at approximately $800 billion, this valuation reflects a surge from previous tender offers, which priced shares at $421.

- Investor interest has reportedly grown for both retail and institutional parties.

- Indirect exposure to SpaceX is available through investments like EchoStar, which has a deal involving spectrum sales valued at $17 billion.

- Other satellite firms such as Globalstar and Iridium could also benefit from increased valuations related to this IPO.

Challenges Ahead

Despite the excitement, Johnsen cautioned that the path to an IPO is fraught with uncertainties. He clarified that critical details—like timing and valuation—remain unclear. Historically, SpaceX executives noted that the company would likely postpone an IPO until they were consistently launching missions to Mars. This timeline amplifies the unpredictability surrounding the IPO process.

In conclusion, while SpaceX’s aspirations for an IPO could significantly transform the landscape of the space industry, various factors will determine its feasibility. The potential for hefty capital could fast-track impressive innovations, but the company remains cautious as it navigates this complex journey.