Debt Collectors Intensify Pursuit of Consumers

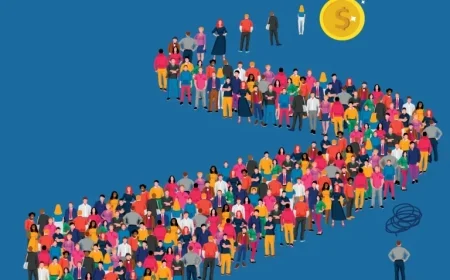

The landscape of debt collection in the United States has changed significantly as federal oversight diminishes. Aggressive tactics employed by large collection agencies are intensifying, targeting consumers struggling with unprecedented levels of credit card debt.

Growing Debt and Consumer Struggles

As of now, the nation grapples with $1.2 trillion in revolving credit card debt. This alarming statistic indicates that many consumers find themselves unable to meet payment obligations. With debt recovery firms ramping up their collections, complaints from consumers are soaring.

Key Incidents Highlighting Debt Collection Abuses

One notable case involves Horst Seibert, a Florida resident who faced wage garnishment due to a $3,300 credit card debt. His wages were reduced by 25% by Midland Credit Management, which had purchased the debt from Citibank. After two years of timely payments, Midland unexpectedly raised Seibert’s outstanding balance by nearly $1,571 without providing any justification.

- Seibert filed a lawsuit against Midland, citing insufficient responses to his queries.

- Midland’s legal representative asserts that only an accounting error occurred.

Rising Consumer Complaints

The Consumer Financial Protection Bureau (CFPB) reported a significant increase in consumer complaints against collection firms. Over the past 11 months, approximately 253,000 complaints have been registered, a substantial rise from 140,000 during the same timeframe in 2024.

Debt Collection Industry Overview

The debt collection industry, valued at $15 billion, comprises numerous firms that frequently face litigation. Notably, Encore Capital, which owns Midland, has seen a boom in lawsuits, with over 600,000 anticipated in 2025 alone.

- Encore Capital recorded annual revenues of $1.5 billion.

- Despite their growth, they face multiple lawsuits for alleged illegal collection practices.

- Approximately 90% of consumers do not show up in court for debt collection lawsuits.

Regulatory Changes Impacting the Industry

As the Trump Administration reduced regulatory frameworks, fewer checks exist on debt collectors. This trend raises concerns regarding potential abuses in the marketplace. Notably, the CFPB previously scrutinized such companies, imposing fines for non-compliance.

The Future of Debt Collectors and Consumers

The current trajectory suggests a challenging environment for consumers as regulatory oversight continues to wane. Industry experts warn that without sufficient regulation, aggressive practices may only worsen. The National Consumer Law Center predicts that financial hardships could lead to increased debt burdens among consumers.

The debt collection landscape remains fraught with challenges as consumers reconcile mounting debts against the backdrop of reduced regulatory protections. Understanding these dynamics is essential for those navigating this increasingly complex environment.