Broadcom Outshines Top Stocks in 2025: Still a Buy for 2026?

Broadcom has recently positioned itself near the forefront of the tech market, demonstrating impressive financial growth and strong positioning within the semiconductor sector. The company is edging closer to achieving membership in the exclusive $2 trillion market capitalization club, alongside technology giants like Nvidia, Apple, and Microsoft.

Broadcom’s Financial Highlights for Fiscal 2025

On December 11, 2025, Broadcom reported its fourth-quarter and full-year results. Key figures include:

- Full-year revenue surged by 24%

- Diluted earnings per share rose by an extraordinary 288%

- Free cash flow increased by 39%

These results highlight Broadcom’s effectiveness in converting sales into high-margin profits while maintaining operational efficiency.

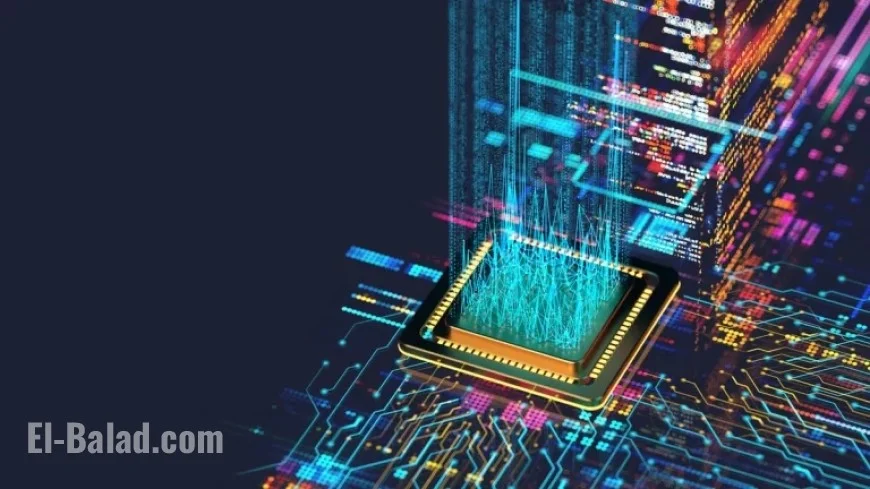

Market Performance and AI Integration

Throughout 2025, Broadcom’s stock outperformed its peers, showing substantial growth compared to other major companies. With a remarkable sevenfold increase in stock price over three years, Broadcom now ranks as the sixth-most valuable company in the U.S.

The company’s revenue structure has evolved, with 58% now generated from semiconductor solutions. Notably, AI semiconductor revenue rose by 74% year-over-year in the last quarter. For the first quarter of fiscal 2026, forecasts predict AI semiconductor revenue could reach $8.2 billion, doubling compared to the same period in 2025.

AI Semiconductor Revenue Projections

Broadcom’s AI semiconductor revenue is expected to make up approximately 42.9% of total revenue for the upcoming fiscal year. The company has seen a dramatic increase in demand for its custom AI chips, which are poised to further drive growth.

Broadcom’s Custom AI Chips in Demand

Broadcom’s custom AI chips are gaining traction among major technology firms. Recent developments indicate that collaborations with companies like Meta are driving demand for Broadcom’s AI solutions.

- Custom chips specialize in task-specific functions.

- These chips offer cost-effective solutions compared to traditional GPUs.

Balanced Business Model

Unlike Nvidia, which heavily relies on AI revenue, Broadcom maintains a diverse portfolio. This balance provides investors with assurance that the company can weather fluctuations in the AI market.

Investing in Broadcom: A Cautious Perspective

Despite its strong performance, Broadcom’s stock is viewed as expensive. Analyst projections suggest earnings per share of $9.39 for fiscal 2026 and $12.72 for fiscal 2027. With a trading price over 30 times these earnings, some investors may question its current valuation.

Long-term Outlook

For long-term investors, Broadcom retains its status as a valuable buy due to consistent growth in earnings and strategic positioning within AI data centers. However, potential investors should be aware of the premium price associated with the stock and approach with caution.

Broadcom is navigating a competitive landscape effectively, yet investors need to consider the risks of possible market slowdowns. As the company continues to innovate, its future trajectory remains promising for those willing to invest at current valuations.