Top CD Rates for December 15, 2025

As of December 15, 2025, investing in a certificate of deposit (CD) remains a favorable option for those looking to secure higher returns. The average yield for CDs has settled at approximately 4.18% annually, following a series of Federal Reserve rate adjustments in 2025. Investors looking to lock in these rates should act promptly, as changes in monetary policy could further impact yields in the coming year.

Overview of Current CD Rates

The highest CD rate available on December 15, 2025, is 4.18%, offered by Citibank for a three-month term. It is important to note that CD rates can differ based on location.

Leading Institutions with Competitive CD Rates

- Wells Fargo

- Capital One

- Chase

- Bank of America

- Discover Bank

- Northern Bank Direct

- Ally Bank

- Newtek Bank

- Popular Direct

- Citibank

- Sallie Mae Bank

Understanding CD Rate Fluctuations

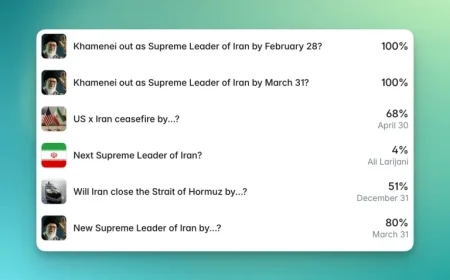

CD rates have historically mirrored the Federal Reserve’s monetary policy. With the federal funds rate currently at 3.50% to 3.75%, rate adjustments made in September, October, and December have influenced the yields on CDs.

Last year, the Fed reduced rates three times, causing average CD yields to drop from previous peaks. This trend may continue, and investors should monitor potential Fed actions in 2026 that could alter interest rates further.

Factors Influencing CD Selection

To secure a good CD rate, several factors should be considered:

- Term Length: Match the CD’s duration with your savings goals.

- APY: Higher rates usually come with longer terms.

- Minimum Deposit: Ensure you meet the required minimum balance.

- Early Withdrawal Penalties: Understand the costs of accessing funds before maturity.

- Deposit Insurance: Verify that your chosen institution is insured by the FDIC or NCUA.

The Benefits of Online Banks

Online banks and fintech companies often provide higher APYs than traditional banks, owing to their lower operating expenses. These institutions focus on attracting deposits by offering competitive rates.

Strategies for Maximizing Your CD Investments

One effective strategy is to create a CD ladder. This involves dividing your savings among multiple CDs with varying maturity dates. For example, you could invest $3,000 across one-year, two-year, and three-year CDs. As each matures, you can reinvest the funds into longer-term CDs, allowing for both access to liquidity and the potential for higher returns.

Types of Certificates of Deposit

Different types of CDs cater to various investment needs. These include:

- Brokered CDs: Sold through brokerage accounts, typically offering higher APYs.

- Callable CDs: Allow issuers to end the CD early, returning investor principal and accrued interest.

- Bump-Up CDs: Enable rate adjustments if market rates increase during the term.

- No-Penalty CDs: Withdraw funds without an early withdrawal fee, though they may feature lower APYs.

- Jumbo CDs: Require a large minimum deposit, often yielding higher interest rates.

- Variable-Rate CDs: Their APYs fluctuate with market interest rates, posing higher risk.

In summary, December 15, 2025, presents a sound opportunity to invest in CDs with competitive rates. Staying informed and selecting the right institution and type will maximize returns effectively.