Fed Rate Cut Lowers Credit Card Costs, Mortgage Relief Delayed

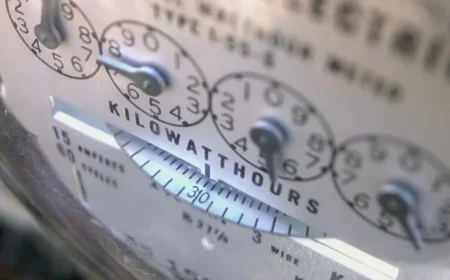

The Federal Reserve’s recent decision to cut short-term interest rates has brought mixed reactions among consumers and economists alike. This move, which lowered the rate by a quarter percentage point, aims to provide relief as inflation concerns persist while also affecting various loan costs.

Recent Fed Rate Cut and Its Implications

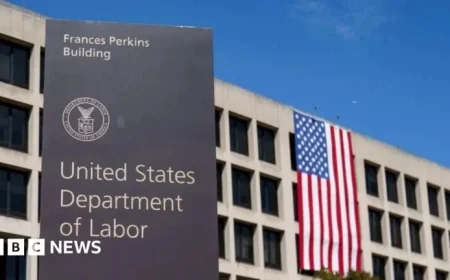

On December 10, the Federal Reserve announced a cut to the federal funds rate, bringing it to a target range of 3.5% to 3.75%. The decision was influenced by signs of slowing job gains and an increase in the unemployment rate, which has raised concerns among policymakers.

The Fed’s rate cut could lead to immediate benefits for consumers, especially in terms of credit card and home equity line of credit (HELOC) rates. Current average rates for HELOCs have dropped to 7.81%, down from 8.55% a year ago, as reported by Bankrate.com.

Mortgage Rates: Outlook for 2026

Despite the Fed’s efforts, the future of mortgage rates appears uncertain. As of December 4, the average interest rate for a 30-year fixed mortgage stood at 6.19%. While this is lower than the previous year’s average of 6.69%, experts do not foresee significant drops in 2026, predicting an average rate of around 6.3% for the year.

Potential Rate Cuts Ahead

Commentators speculate about the potential for further rate cuts in 2026, with some economists forecasting one to three additional cuts. This number could depend heavily on the job market’s performance and inflation trends.

- Economist Carl Tannenbaum predicts only one more rate cut in the first half of 2026.

- Mark Zandi forecasts three cuts within the same timeframe due to slowing job growth.

Economic Challenges and Consumer Spending

Economic uncertainty continues, characterized by sluggish consumer spending growth. In 2025, real consumer spending rose only 1.3%, compared to 2.95% in the previous year. High prices are still impacting lower- and middle-income households, causing them to restrain spending.

Impact of Tariffs and Inflation Concerns

The backdrop of ongoing tariff disputes and inflation has created a challenging environment for consumers. Prices for various goods may rise as businesses adapt to the economic landscape, potentially hindering the Fed’s capacity to cut rates liberally in the future.

Benefits for Auto Loans and Mortgages

Despite inflation concerns, the recent Fed rate cut has the potential to alleviate some financial burdens. Borrowers may find refinancing auto loans more appealing with rates possibly falling below 7% in 2026. This could provide significant savings for those looking to lower monthly payments.

Conclusion: Navigating the K-Shaped Economy

The current economic climate illustrates a K-shaped recovery, where higher-income households benefit from gains in stocks and real estate, while lower-income families struggle with rising costs. The Fed’s actions in 2026 will be crucial in determining how these dynamics evolve, particularly for those seeking to refinance loans or make significant purchases.

As consumers look to navigate these economic complexities, they may benefit from the anticipated reductions in credit card and home equity loan rates, though the same cannot be assumed for long-term mortgage rates.