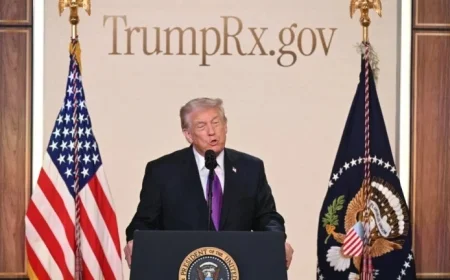

Bank of England Lowers Interest Rates to 3.75% – Latest Updates

The Bank of England has announced a decrease in interest rates, lowering them to 3.75%. This change comes amid concerns about a sluggish economy and is the sixth reduction since the last summer.

Bank of England Cuts Interest Rates

Governor Andrew Bailey highlighted the strategic timing of this rate cut, occurring just before the Christmas season. While this adjustment may benefit borrowers and businesses, the Bank of England issued a cautionary note. Future rate cuts may not occur at the same pace in the upcoming year.

Economic Concerns

- The decision was closely contested, with Bailey providing the crucial vote to shift from maintaining rates to cutting them.

- There are worries regarding a lack of consumer spending and business investment.

- The economy is not expected to grow in the final quarter of 2025.

Andrew Bailey remarked that the peak of inflation has likely passed. The central bank now predicts that inflation rates will approach their target by April, earlier than previously estimated, which was initially set for 2027.

Impact of the Budget Measures

Bailey confirmed that the recent Budget measures from the Chancellor are expected to reduce the headline inflation rate by 0.5 percentage points.

Future Prospects

The current cut brings base rates below 4% for the first time since early 2023. While the Monetary Policy Committee agrees that interest rates are likely to continue declining, some members suggest that the rate of cuts may slow down.

Much depends on whether businesses and consumers, who have been cautious in their spending and have opted to save more, will regain confidence in the economy.