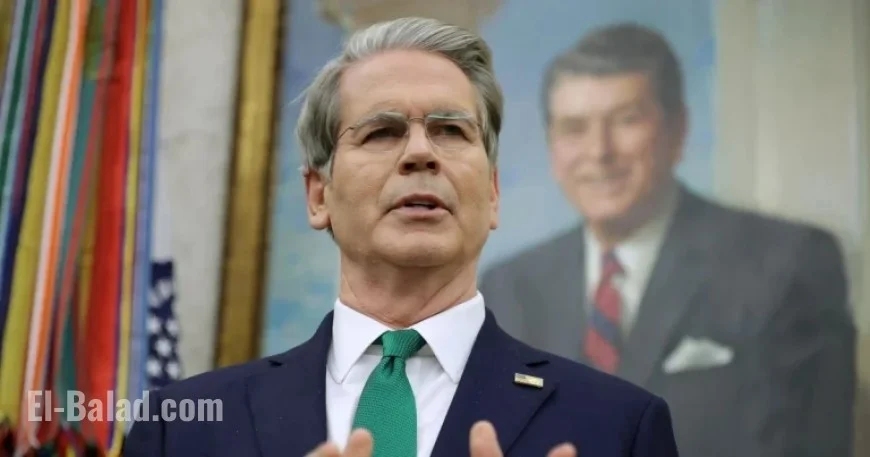

Bessent Launches Trump Accounts Site to Boost Children’s Savings

Treasury Secretary Scott Bessent recently launched the Trump Accounts program, designed to boost children’s savings through tax-deferred investment vehicles. This initiative aims to provide American children with a financial head start upon birth.

Details of the Trump Accounts Program

The program offers a $1,000 contribution for accounts established for U.S. children born between January 1, 2025, and December 31, 2028. Bessent highlighted that this initial deposit could grow significantly over time. He reported that if invested at the historical growth rate, $1,000 could potentially increase to more than $600,000 by the time the child reaches retirement age.

- Families can contribute up to $5,000 annually.

- Such contributions could lead to a total of $1 million by retirement.

Investment Management Guidelines

The funds in Trump Accounts are to be invested in authorized financial instruments, including mutual funds or exchange-traded funds that track major indices like the S&P 500. This ensures that the children’s savings are managed effectively. Importantly, financial institutions managing these accounts may not charge more than 0.1% in annual fees.

Eligibility and Registration

To benefit from the Trump Accounts program, parents must fill out IRS Form 4547 when filing taxes to sign up their children. This form will initiate the activation of the child’s account, managed by a financial institution.

Key Partnerships and Contributions

The program has garnered support from notable figures in finance. Billionaire hedge fund manager Ray Dalio, founder of Bridgewater Associates, has committed $75 million to support the program. Dalio’s efforts are part of a larger push to encourage businesses and philanthropic organizations to contribute across all 50 states.

- Dalio Philanthropies announced an additional $250 contribution per child for approximately 300,000 children in Connecticut.

- Michael and Susan Dell pledged $6.25 billion to enhance children’s savings, contributing $250 for each of 25 million children aged 10 and under.

Future Access to Funds

Families will be permitted to make contributions starting July 5, 2026. However, funds cannot be withdrawn until the child turns 18 unless specific conditions are met.

The Trump Accounts program constitutes a significant initiative aimed at securing financial futures for American children, encouraging early savings, and fostering investment in their growth and development.