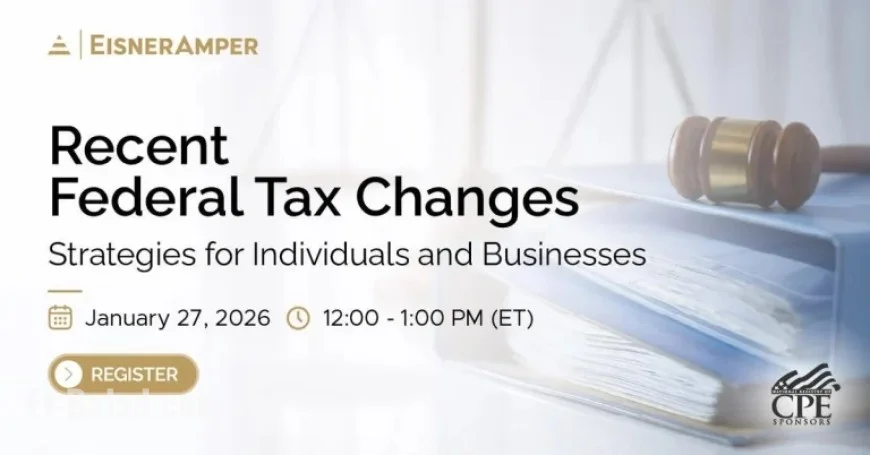

Federal Tax Updates: Essential Strategies for Individuals and Businesses

Recent developments in federal tax law require attention from both individuals and businesses. This article details essential strategies to navigate the changes brought about by the One Big Beautiful Act.

Key Changes in Federal Tax Law

The One Big Beautiful Act introduced several significant alterations in tax regulations. It is crucial to grasp these changes to make informed decisions in your financial planning.

Actionable Strategies for Tax Planning

- Understand the implications of the new tax laws.

- Identify strategies that benefit both individuals and businesses.

- Implement actionable techniques to optimize tax liabilities.

Learning Outcomes for Participants

Participants in tax-related courses can expect several key outcomes:

- Clarity on recent federal tax law updates.

- Strategies tailored for both personal and business tax situations.

- Eligibility for 1.0 CPE credit in Taxes.

Staying informed on federal tax updates is crucial. Understanding the recent modifications and leveraging strategic planning can lead to more effective financial outcomes.