Economists Challenge New Government Data Showing No Housing Inflation

Recent government data has ignited debate among economists regarding the apparent absence of housing inflation, as depicted in November’s consumer price index (CPI) report. The report indicates a modest rise in consumer prices of only 2.7% year-over-year, with core inflation settling at 2.6%. However, many experts consider these figures misleading, particularly concerning the housing sector.

Experts React to Housing Inflation Data

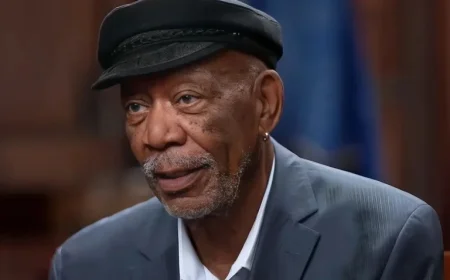

Diane Swonk, chief economist at KPMG, expressed skepticism over the reported numbers. She labeled the data as “wacky,” noting that shelter costs effectively stagnated. Swonk emphasized that housing is a major component of the consumer price index, which makes its accurate representation critical.

This skepticism is partly attributed to an extended government shutdown. The shutdown hampered the Bureau of Labor Statistics’ (BLS) ability to collect vital price data during October, resulting in unverified statistics for November. Rather than conducting thorough retrospective data collection, the BLS relied on statistical assumptions, leading to potential inaccuracies in the inflation readings.

Impact of the Government Shutdown

- The extended shutdown limited data collection efforts for vital October pricing.

- Assumptions made by the BLS led to a significant distortion in housing data, particularly shelter costs.

- Prices for rents and owners’ equivalent rents were effectively reported as unchanged in October.

Joseph Brusuelas, chief economist at RSM, echoed these concerns. In a recent blog post, he advised treating the November report with caution, citing flaws that obscure the true state of inflation. “This was one flawed CPI report,” Brusuelas stated, highlighting the unusual data that lacks typical detail and breadth.

Market Response and Federal Reserve Considerations

Market reactions to the report were notably subdued. Instead of a typical rally in stock values following a dip in inflation, stock movements were minimal. This cautious market sentiment appeared to reflect broader skepticism regarding the validity of the reported data.

While the figures suggest support for the Federal Reserve’s recent interest rate cuts, economists warn against making policy decisions based on distorted data. Swonk noted that the Fed is aware of these discrepancies and will approach the data with caution. She pointed out that the information regarding inflation is less reliable than labor market indicators.

Housing Affordability Issues Persist

Despite indications of cooling inflation, housing affordability remains a pressing concern. Swonk stressed that inflation and affordability are distinct issues. Rising costs associated with mortgages, insurance, and utilities continue to burden households, complicating the financial landscape.

| Cost Category | Trend |

|---|---|

| Mortgage Rates | Rising |

| Utility Costs | Increasing |

| Electricity Prices | Rising |

| Natural Gas Prices | Increasing |

As discussions continue, broader economic signals suggest that the current inflation scenario is more about noise than clarity. Both Swonk and Brusuelas emphasize the importance of approaching the latest data with skepticism as they caution stakeholders and policymakers against making hasty decisions.