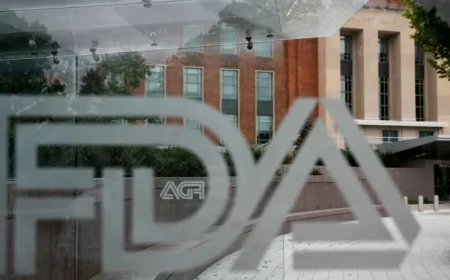

California and Other States Sue to Block Federal Consumer Agency Shutdown

California and 20 other states, along with the District of Columbia, have initiated a significant lawsuit aimed at blocking efforts to defund the Consumer Financial Protection Bureau (CFPB). This legal action, filed in U.S. District Court in Eugene, Oregon, accuses Acting Director Russell Vought of unlawfully withholding funds from the bureau.

Details of the Lawsuit Against the CFPB

The lawsuit, led by California Attorney General Rob Bonta, claims that Vought’s interpretation of the CFPB’s funding statute is both illegal and detrimental to consumer protection efforts across the states.

- Filed by: California, Oregon, New York, New Jersey, Colorado, and others

- Court: U.S. District Court, Eugene, Oregon

- Key Defendants: Russell Vought, CFPB, Federal Reserve Board of Governors

- Impact: Loss of access to valuable consumer complaint database and resources

Significance of the CFPB

Established in 2010 in the wake of financial crises linked to subprime mortgages, the CFPB is essential for state-level consumer protection initiatives. This agency operates independently, funded through the Federal Reserve to avoid political pressures.

The lawsuit underscores the agency’s role in processing millions of consumer complaints. According to the complaint, the CFPB faces potential cash shortages if funding is not restored. The complaint details a critical timeline, indicating that without action, the agency could be financially depleted by next month.

Federal Administration’s Stance

Vought has been a prominent figure in efforts to diminish the CFPB’s operations since assuming leadership. The lawsuit challenges his new interpretation of funding, which claims that the agency should only receive funding based on the Federal Reserve’s profits—essentially zero, since the Fed has operated at a loss since 2022.

Background on the CFPB’s Achievements

Historically, the CFPB has aided consumers by returning nearly $21 billion through various enforcement actions. However, recent developments show a decline in its activity:

- Early termination of consent orders with major financial institutions.

- Withdrawal of significant lawsuits providing consumer protection.

Critics, including Colorado Attorney General Philip Weiser, express frustration at Congress for not defending the CFPB against these funding changes. This litigation marks another attempt to maintain the agency’s operational status amid ongoing challenges to its authority.

As the lawsuit unfolds, its implications for consumer protection law and enforcement remain to be seen, particularly under the current political administration.