Experts Predict 2026 Housing Market Trends: Will Your Home Value Increase?

As we look ahead to the 2026 housing market, predictions suggest a complex landscape for home values. While many experts expect prices to continue rising, some caution that inflation could outpace this growth.

2026 Housing Market Forecast

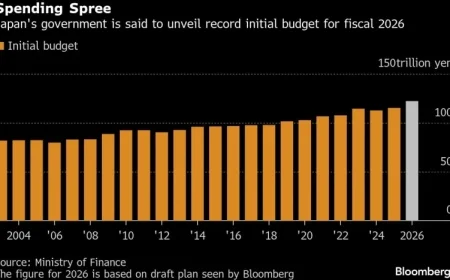

The projected increase in home prices varies widely among economists. The National Association of Realtors anticipates an appreciation of approximately 4% in 2026. In contrast, Fannie Mae and Zillow predict much more modest increases of 1.3% and 1.2%, respectively. These rates fall below expected inflation levels, suggesting a potential decline in housing wealth in some regions.

Inflation vs. Home Prices

According to the Federal Reserve Bank of Philadelphia, the Consumer Price Index (CPI) inflation rate is forecasted to reach 2.6% by the fourth quarter of 2026. This discrepancy between home price growth and inflation raises questions about the overall strength of the housing market.

- National Association of Realtors: 4% increase

- Fannie Mae: 1.3% increase

- Zillow: 1.2% increase

- Federal Reserve CPI inflation projection: 2.6%

Factors Influencing Home Value Trends

Several factors are contributing to the forecasted trends. Increased housing supply is expected to ease price growth. More available homes provide buyers with additional options, even as mortgage rates remain high, hovering around 6% in 2026. This combination could suppress demand and lessen upward pressure on prices.

Mike Fratantoni, Chief Economist of the Mortgage Bankers Association, emphasizes that greater inventory will likely lead to downward pressure on home prices nationwide.

Geographical Variations in Home Prices

The housing market’s dynamics differ significantly across the U.S. Certain metropolitan areas are witnessing a resurgence in home price increases. For example, Chicago leads with a 5.5% annual gain, followed by New York at 5.2%, and Boston at 4.1%.

Conversely, regions that gained popularity during the pandemic, such as parts of Florida and Arizona, are now showing price declines. Nicholas Godec of S&P Dow Jones Indices notes this shift, indicating a reversion to traditional market fundamentals.

Emerging Hotspots

Redfin identifies several regions likely to become housing hotspots in 2026, particularly in suburban areas surrounding major cities. Promising markets include:

- New York City suburbs (Long Island, Hudson Valley)

- Northern New Jersey

- Fairfield County, Connecticut

- Cleveland

- St. Louis

- Syracuse

- Minneapolis

- Madison, Wisconsin

Regions such as Miami, Fort Lauderdale, and Austin are expected to experience a cooling trend, highlighting the contrasting conditions within the housing market.

Conclusion

As we approach 2026, navigating the housing market will require a keen understanding of local conditions and economic indicators. While some regions may experience growth, the interplay between inflation, interest rates, and inventory levels will play a crucial role in determining home values across the country.