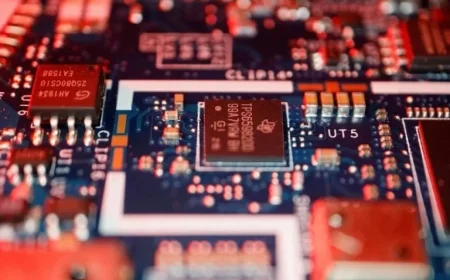

Copper Prices Surge in China and New York Amid Supply Concerns

Copper prices are experiencing significant increases both in Shanghai and New York, driven by concerns over global supply shortages. Investors are increasingly optimistic about the metal’s potential, particularly as we approach 2026.

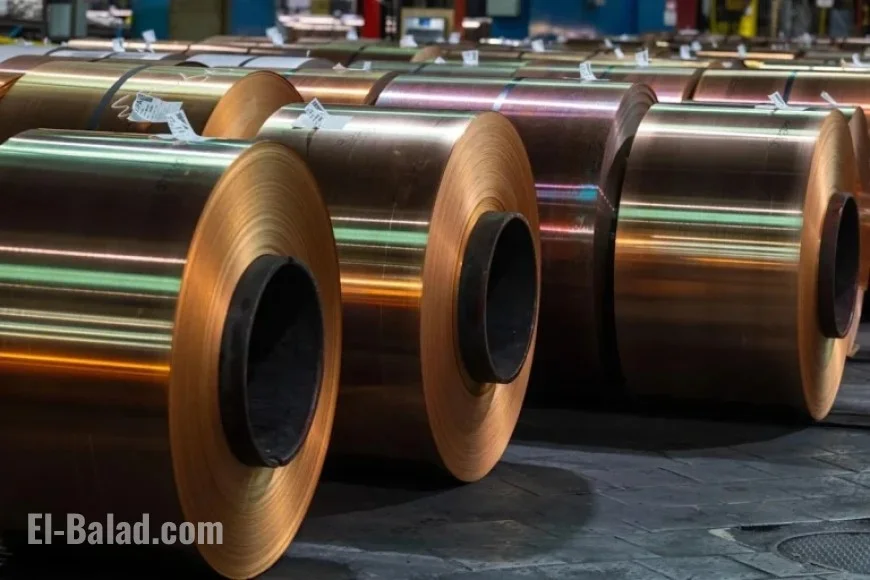

Record Copper Prices in Shanghai

On the Shanghai Futures Exchange, copper prices surged by approximately 4.7%, reaching nearly 100,000 yuan, equivalent to around $14,270 per ton. This marks a historic high for the market.

New York Market Trends

In New York, copper futures on the Comex increased by 4.2%, trading at $5.8075 per pound. This level represents the highest price since a notable short squeeze occurred in July.

Factors Contributing to Price Surge

- Expectations of tighter global supplies.

- Weakening US dollar, making commodities cheaper for international buyers.

- Increased demand as industries transition towards energy solutions.

Overall Market Conditions

The final trading days of the year have seen a broad increase in precious metals, with gold, silver, and platinum also reaching record prices. This rally reflects widespread market optimism amid various geopolitical and economic uncertainties.

2025 and Beyond

Analysts suggest that copper is poised to be a key player in the energy transition and could see substantial gains of about 42% in the New York market by 2025. The demand for copper is expected to rise as nations strive to implement greener technologies.

Potential Policy Changes

Earlier this year, there was speculation around tariffs on copper imports. Although the tariffs were ultimately not applied to the most common forms of copper, this decision will be revisited in 2026, potentially impacting supply dynamics.

Conclusion

The copper market is poised for volatility in the upcoming months as supply concerns persist and global demand rises. Investors will be watching closely as the year unfolds.