China Commits to Stabilize Yuan’s Exchange Rate Against Overshooting

China has reiterated its commitment to stabilizing the yuan’s exchange rate against overshooting. This pledge reflects a determination to curb rapid appreciation of the currency, as stated in the People’s Bank of China’s (PBOC) recent report on financial stability for 2025.

Key Measures from the PBOC

In its report released on Friday, the PBOC emphasized its approach to allow flexibility in the yuan’s exchange rate while implementing stronger mechanisms to manage market expectations. The bank aims to mitigate risks associated with significant fluctuations.

Daily Reference Rate Adjustment

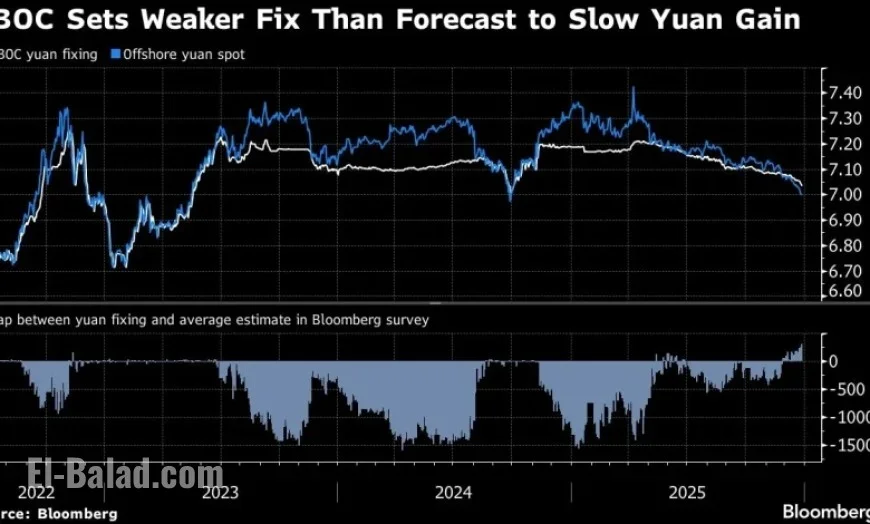

Earlier on the same day, the PBOC set the yuan’s daily reference rate significantly below market predictions. The rate was fixed at 7.0358 per dollar, marking a deviation of 301 pips from trader and analyst estimates compiled in a Bloomberg survey. This adjustment reflects the largest gap since the survey’s inception in 2018.

The offshore yuan briefly crossed the crucial threshold of 7 per dollar, a level not seen since September 2024. The recent moves aim to ensure a gradual pace of appreciation, thus helping to manage capital inflows from speculative investments.

Economic Perspectives and Predictions

Analysts, including Zhaopeng Xing from Australia & New Zealand Banking Group, noted that the PBOC’s strategy signals its unwillingness to allow hasty appreciation of the yuan. The approach aligns with the central bank’s commitment to avoid risks related to exchange rate overshooting. Despite the recent adjustments, the yuan remains stronger compared to the previous trading session.

- Offshore yuan consolidates at 7.0043 after recent gains.

- Major banks like Goldman Sachs and Bank of America predict further strengthening of the yuan in 2026.

- Calls for a stronger currency arise from local economists to shift the economy away from export dependence.

While some fluctuations are expected, the PBOC’s cautious stance, along with interventions from state banks to buy dollars, aims to mitigate excessive speculation on the yuan’s value. Analysts from China Minsheng Bank foresee that seasonal foreign-exchange settlements will provide some upward support for the currency in early 2026.

Challenges Ahead

Despite these measures, achieving significant appreciation of the yuan may prove challenging. Analysts anticipate that without a clear upward trend, the yuan is unlikely to strengthen past 6.9 per dollar in the short term. The PBOC’s systematic approach and careful monitoring of the market will be crucial in maintaining the desired exchange rate stability.