Judge Orders Trump Administration to Pursue CFPB Funding

A federal district court ruling has mandated the Trump administration to continue pursuing funding for the Consumer Financial Protection Bureau (CFPB). The CFPB, established to protect consumers following the 2008 financial crisis, has been facing significant attempts to diminish its operations through staffing and budget cuts.

Judge’s Ruling on CFPB Funding

On Tuesday, Judge Amy Berman Jackson rejected the administration’s claims that the CFPB could not receive any funds due to the Federal Reserve’s financial status. The administration argued that since the Fed was operating at a loss, it could not allocate funds to the CFPB. Judge Jackson countered this assertion, cautioning that such a stance would substantially threaten the existence of the bureau.

Background on CFPB and Legal Challenges

- The CFPB was established post-2008 financial crisis.

- Its primary role includes collecting consumer complaints against businesses.

- The bureau has faced opposition primarily from conservative factions.

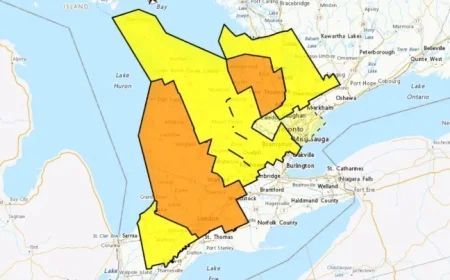

This ruling supports Jackson’s prior injunction aimed at maintaining the bureau’s functioning as required by Congress. It also seeks to halt any attempt to defund the agency, which includes resisting planned layoffs. Notably, a coalition of 21 states and the District of Columbia recently filed a lawsuit to challenge the administration’s interpretation of funding eligibility.

Implications of the Ruling

Judge Jackson emphasized that the CFPB operates without taxpayer dollars, having returned over $21 billion to consumers. She noted that the agency is “hanging by a thread” and reiterated that the administration is “actively and unabashedly trying to shut the agency down again.”

Timeline of Events

| Date | Event |

|---|---|

| February 10, 2025 | CFPB headquarters view in Washington, DC |

| April 2025 | Layoff notices sent to approximately 1,400 CFPB employees. |

| December 2025 | A court ruling vacated the prior decision regarding layoffs. |

The ongoing legal battles highlight significant tensions between the Trump administration and the CFPB, raising questions about the future operations of the bureau, which plays a crucial role in consumer protection.