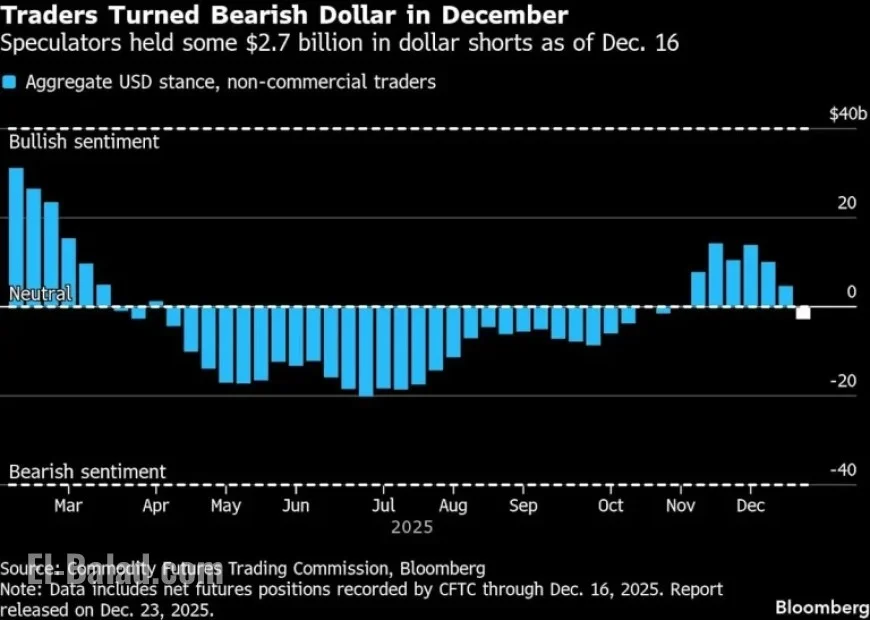

Dollar Faces Biggest Decline Since 2017 Amid Fed Uncertainty

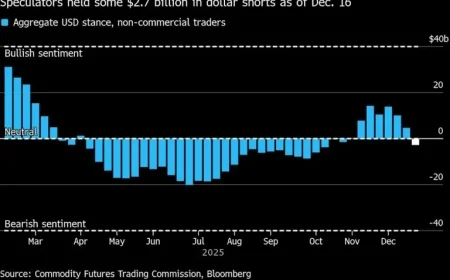

The dollar is experiencing its most significant decline since 2017, as it appears on track for an 8% drop this year. Investors anticipate further declines if the next chair of the Federal Reserve (Fed) implements deeper interest-rate cuts. This sentiment has intensified following a series of events, including President Donald Trump’s tariffs in April and his ongoing efforts to appoint a dovish Fed leader.

Current Market Trends for the Dollar

The Bloomberg Dollar Spot Index has shown substantial volatility. Initially, the dollar fell sharply after the “Liberation Day” tariffs were introduced. This decline set the stage for continued weakness as Trump campaigned for a more accommodative policy approach from the Fed.

The Role of the Federal Reserve

The direction of the dollar largely hinges on forthcoming decisions by the Fed. Yusuke Miyairi, a foreign-exchange strategist at Nomura, emphasizes that the upcoming Fed chair’s decisions will be pivotal. The current chair, Jerome Powell, is set to end his term in May. This uncertainty adds pressure on the dollar.

Interest Rate Projections

- Market expectations include at least two interest rate cuts next year.

- In contrast, other developed economies signal potential rate hikes.

- The euro has gained against the dollar, driven by low inflation and robust defense spending in Europe.

Recent data from the Labor Department indicated a drop in new unemployment claims, momentarily boosting the dollar by 0.2%. However, the dollar is projected to conclude December down approximately 1% overall.

Future Implications and Candidates for Fed Chair

The market is closely watching who will succeed Powell. Trump has hinted at a preferred candidate but has yet to reveal any names. National Economic Council Director Kevin Hassett is regarded as the frontrunner, with former Fed governor Kevin Warsh, and Fed governors Christopher Waller and Michelle Bowman also mentioned in discussions. Each potential candidate could significantly influence monetary policy and, consequently, the dollar’s trajectory.

Andrew Hazlett, a trader at Monex Inc., notes that Hassett is likely already priced into the market. In contrast, Warsh and Waller may favor a more cautious approach to rate cuts, which could stabilize the dollar.

Market Sentiment and Forecasts

Experts suggest that the dollar’s long-term outlook remains precarious. Skylar Montgomery Koning, a macro strategist, indicates that despite predictions of ongoing dollar weakness, historical performance shows that consensus forecasts often lag behind actual market movements.

As the Fed’s leadership changes and potential policy shifts loom, the future of the dollar will depend on economic signals and investor confidence in U.S. monetary policy.