Retirement Investors Cautioned Amid Volatile ‘Marie Antoinette’ Market

Investors are navigating a challenging economic environment, often referred to as a “Marie Antoinette” market. This term reflects the disconnect between the wealthy elite and the average worker navigating retirement. High-profile remarks from public figures have illustrated this disparity. As U.S. investors take risks in their retirement portfolios, it is crucial to understand the dynamics of the current market.

Market Turbulence and Investor Sentiment

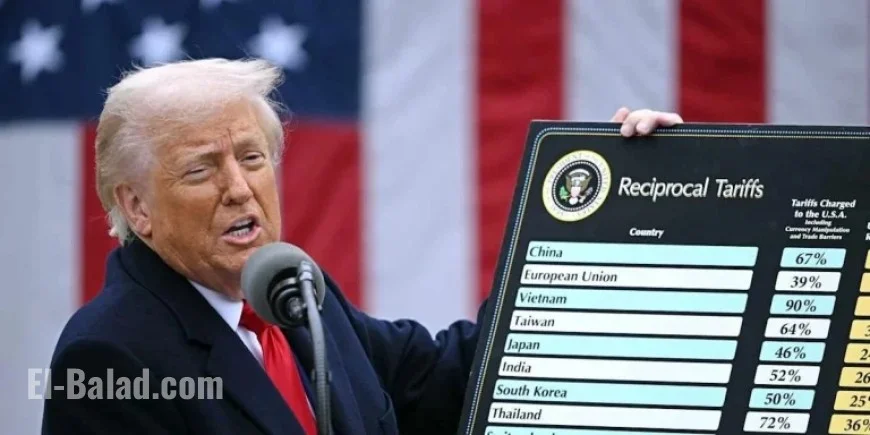

April witnessed significant upheaval in the stock market following President Trump’s “liberation day” tariff announcement. This event resulted in a drastic drop of approximately 4,000 points in the Dow Jones Industrial Average in just a few days. Comments from officials, including Trump, who referred to investors as “weak” for reacting to the turmoil, underscore a troubling trend.

Understanding Volatility

For average Americans, market volatility poses significant challenges. Treasury Secretary Scott Bessent suggested that potential retirees should not fret over daily fluctuations. However, this perspective fails to consider the reality for those dependent on their 401(k) plans. For many, these funds represent their primary financial lifeline.

- Average investors often panic during significant market drop-offs, fearing further declines.

- Many individuals removed their funds from stock and bond markets during last year’s turmoil.

- Recent statistics indicate that drops of 20% or more can trigger real fears for ordinary families.

Investment Strategies for Uncertain Times

Investment strategies must adjust in response to market conditions. Peter Bernstein, an esteemed investment guru, advocated for a balanced portfolio known as the 60/40 strategy. This involves allocating 60% to stocks and 40% to bonds, aiming to mitigate risk and enhance stability.

Diversification is Key

For effective safeguarding against volatility, diversification across global markets is essential. This strategy minimizes risk and can enhance returns. Notably, global funds often outperform domestic-focused funds, making them a compelling choice for investors:

| Fund Type | Annual Fees |

|---|---|

| Vanguard Total World Stock ETF | 0.6% |

| Vanguard Total World Bond ETF | 0.5% |

As these funds illustrate, the costs associated with global diversification are minimal. In an era marked by uncertainty, being mindful of market dynamics is crucial. The gap between affluent investors and everyday Americans continues to widen, highlighting the urgency for a more equitable financial landscape.