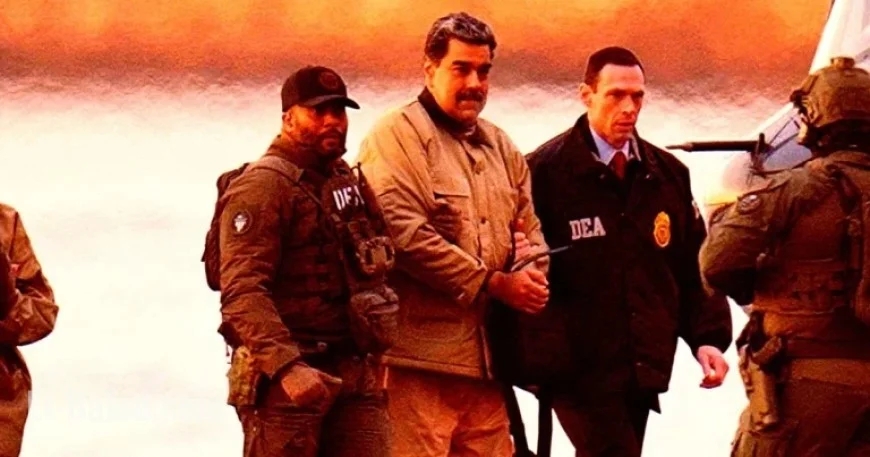

Evidence Shows Trump Ally Profited from Venezuelan Invasion Bets on Polymarket

Recent findings reveal significant insider trading activity linked to the Trump administration’s alleged regime change plans in Venezuela. A user on the prediction market Polymarket reportedly placed substantial bets indicating knowledge of imminent US actions against Venezuelan President Nicolás Maduro.

Evidence of Insider Trading on Polymarket

Researcher Tyson Brody discovered that an anonymous account on Polymarket invested over $30,000 shortly before a US operation aimed at capturing Maduro and his wife. This account quickly became the largest holder in the market predicting Maduro’s ousting.

Timing and Profits

The user profited around $400,000 within just 24 hours. This sequence of events raises eyebrows regarding the source of the information that guided the user’s betting strategy.

- Investment Amount: Over $30,000

- Profit: Approximately $400,000

- Timeframe: Less than 24 hours

Concerns with Prediction Markets

Prediction markets like Polymarket have faced criticism due to their potential for facilitating insider trading and manipulation. Notably, one user previously earned $1 million in a day based on the accuracy of their predictions in a different market.

The Trump administration has been accused of fostering conditions that allow such practices. Critics assert that this clientele may influence policy for personal gain.

The Implications of Insider Knowledge

In the context of military action, insider knowledge poses grave ethical questions. Individuals without privileged insights may suffer the consequences of these manipulative bets during dangerous conflicts.

Demand Progress executive director Sean Vitka highlights concerns about military actions being influenced by those who profit from them:

- Insider Profits: Beneficiaries include those privy to sensitive information.

- Public Risks: Citizens may bear the brunt of conflicts spawned from manipulated choices.

The Future of Prediction Markets

The lack of robust regulations has allowed sites like Polymarket to thrive. As discussions of ethical guidelines intensify, the potential for future abuses remains a pressing concern.

Questions linger about who may be leveraging inside information, whether it be insiders in news organizations or government officials. The ramifications extend far beyond financial gain, affecting lives in conflict zones.