Trump Proposes U.S. Compensation for Oil Firms Rebuilding Venezuela Infrastructure

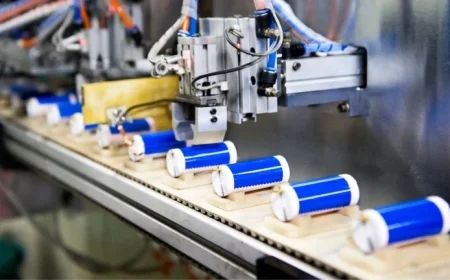

President Donald Trump has expressed confidence that the U.S. oil industry can restore operations in Venezuela within 18 months. During an NBC News interview, he emphasized the substantial investment required from oil companies, stating that they would be reimbursed by either the U.S. government or through future revenue. However, specific estimates on the total costs for repairing Venezuela’s aging oil infrastructure were not provided.

U.S. Oil Companies’ Skepticism

Despite Trump’s optimism, major oil companies remain hesitant to invest in Venezuela due to a history of asset seizures, ongoing U.S. sanctions, and current political instability. Trump noted that harnessing Venezuela’s oil reserves could help reduce global oil prices, which have recently hit multi-year lows. The average retail gas price was reported at $2.81, the lowest since March 2021.

Financial Implications for Oil Companies

The prospect of lower oil prices may translate to reduced revenues for the oil companies that Trump hopes will invest billions in revamping Venezuela’s oil sector. Addressing the administration’s military actions against Nicolás Maduro, Trump acknowledged that while discussions with oil companies took place about potential strategic moves, no specific briefings were given before recent operations.

- Energy Secretary Chris Wright will engage with executives from Exxon Mobil and ConocoPhillips to discuss future plans for Venezuela.

- The Trump administration claims a strong interest from the U.S. oil industry in returning to Venezuela, despite the risk factors involved.

Historical Context of Oil Investments in Venezuela

Venezuela has one of the world’s largest oil reserves, yet a complicated history affects current investment discussions. In the 1970s, the Venezuelan government nationalized energy assets owned by American companies. This included significant holdings from Exxon Mobil and ConocoPhillips, both of which faced difficulties recovering losses from these actions. Although Chevron remains active in Venezuela, it has done so under a limited waiver exempting it from U.S. oil sanctions.

Current Stance of Major Oil Firms

Executives from top oil companies have shown caution regarding exploration and investment in Venezuela. Recently, Exxon Mobil’s CEO Darren Woods highlighted the past expropriation experiences, stating that any potential re-entry would depend on evaluating the economic landscape. Chevron has refrained from commenting on future investments but remains a presence in the country.

As discussions continue, the future of Venezuela’s oil industry and the involvement of U.S. companies remains uncertain against the backdrop of political and economic challenges. The Trump administration’s next steps will be crucial in shaping this strategic energy landscape.