Investor Predicts Venezuela Shift Diminishes Russia’s Oil Importance

Michael Burry, renowned investor and creator of the successful strategy depicted in “The Big Short,” has speculated that recent U.S. actions in Venezuela could diminish Russia’s significance in the global oil market. Following the U.S.-led regime change in Venezuela, Burry addressed the potential consequences for Russia in his Substack newsletter, “Cassandra Unchained.”

Significant Shift in Venezuelan Oil Dynamics

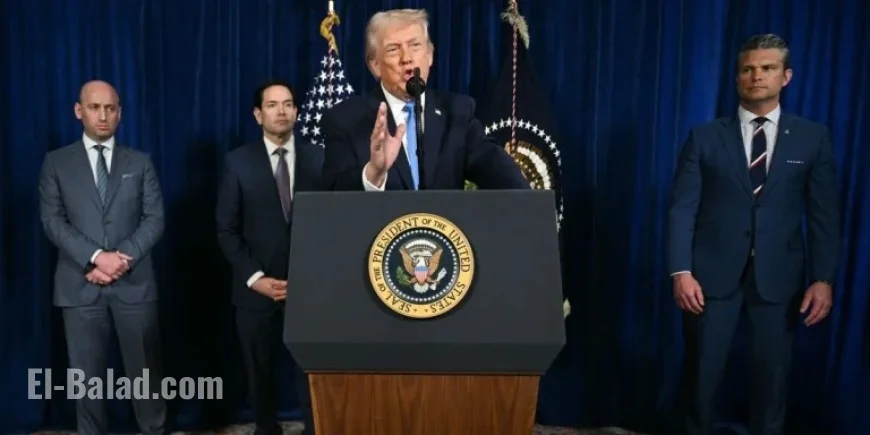

On early Saturday, U.S. forces captured Venezuelan President Nicolás Maduro. In the aftermath, President Donald Trump emphasized the need for U.S. oil companies to invest heavily in Venezuela’s oil infrastructure. Trump pledged that American firms could potentially sell Venezuelan oil internationally.

Burry estimated that although the complete revitalization of Venezuela’s oil production might take five to seven years, a surge in output could significantly undermine Russian oil revenues. “Russian oil just became less important in the intermediate and long-term,” Burry stated.

Venezuela’s Oil Reserves

Venezuela controls approximately 19% of the world’s oil reserves, equating to an estimated 300 billion barrels. In comparison, the U.S. boasts around 61 billion barrels, according to the Energy Institute. However, Venezuela’s output is currently hampered by outdated infrastructure and U.S. sanctions.

- Current Venezuelan oil production remains a fraction of its potential.

- Increased production could impact global oil prices.

- Venezuelan oil output could affect Russia’s financial status significantly.

Economist Aleksandar Tomic stated that if Venezuela increases its oil output, it could lead to a decline in oil prices globally. This would create issues for Russia, as its economy heavily relies on oil, which constitutes around 20% of its GDP.

Uncertain Future Leadership

The future governance of Venezuela following Maduro’s ousting remains uncertain. Venezuelan Vice President Delcy Rodriguez has assumed the role of interim president. Questions linger about whether U.S. oil companies will return to Venezuela, with firms like ConocoPhillips and ExxonMobil having previously exited the country.

- Chevron is currently the only U.S. oil company operating in Venezuela.

- A spokesperson from ConocoPhillips has stated they are observing developments closely.

- ExxonMobil has yet to provide comments on possible future strategies.

The potential for U.S. companies to tap into Venezuela’s vast oil reserves is appealing, especially as American production is projected to peak in 2027 before declining. Burry predicts enhanced U.S. involvement in Venezuelan oil could alter global energy geopolitics significantly.