Dogecoin 2x ETF Leads 2026 as DOGE Shows V-Shaped Recovery

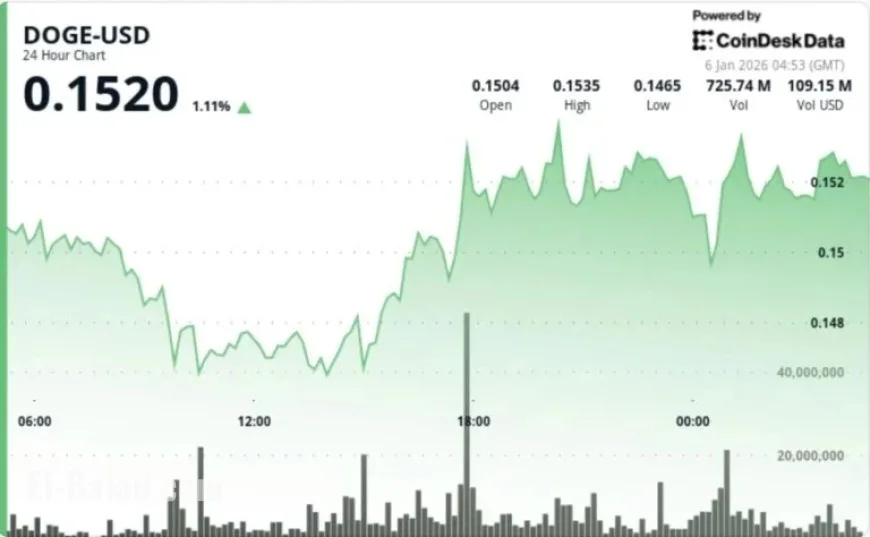

Dogecoin (DOGE) has displayed a notable V-shaped recovery, recently rising from a low of $0.1461. Following this dip, DOGE has stabilized around the $0.151 to $0.152 range, attracting considerable trading volume. This resurgence in interest comes as a 2x Dogecoin ETF has been recognized among the top-performing exchange-traded funds at the beginning of 2026.

Key Highlights of Dogecoin’s Recovery

- Current Price: DOGE is trading just under $0.152.

- Lowest Recorded Price: The asset reached a low of $0.1461 on January 5, 2026, at 09:00.

- Trading Volume: Approximately 880 million tokens exchanged hands during the recovery phase, confirming intense market activity.

- Acting Support Levels: The significant support level is noted at $0.1513.

- Volume Surge: Trading volume during the recovery surpassed the 24-hour average by 87%.

Market Context

Meme coins like Dogecoin and PEPE are currently driving market trends as traders engage in what is being termed “meme season.” According to CoinGecko’s GMCI Meme Index, there has been a noticeable increase in this category. The momentum has also prompted interest in various ETFs linked to these cryptocurrencies.

ETFs and Market Sentiment

Eric Balchunas, a Bloomberg analyst, noted that the 2x Dogecoin ETF has been one of the standout performers in early 2026. This highlights a broader trend where high-beta investments are attracting trader interest despite a somewhat stagnant macro environment for major cryptocurrencies like Bitcoin.

Technical Analysis of Dogecoin’s Price Action

- V-Shaped Recovery: DOGE’s rebound from $0.1461 showcases a strong recovery pattern.

- Price Attempts: DOGE reached a high of $0.1536 before consolidating.

- Price Action: Following the rally, DOGE’s price stabilized, revealing a post-recovery trading range.

The consolidation phase occurred after a peak at $0.1536, where selling pressure tested support levels near $0.1513. Despite this, DOGE showed resilience and bounced back, indicating bullish sentiment among traders.

Future Trading Considerations

Traders should monitor the following scenarios closely:

- If the price maintains above $0.1513, DOGE may continue to retest resistance levels around $0.1540 to $0.1543.

- A breakthrough above $0.1540 could signal extended momentum and draw additional trend-following capital.

- Conversely, breaking below $0.1513 may signal a risk of a broader retracement, bringing the focus back to $0.1461.

The ongoing performance of the 2x Dogecoin ETF emphasizes changing risk appetites in the cryptocurrency market. While this ETF’s success does not alter DOGE’s fundamental position, it does reflect traders’ tendencies toward high-risk assets and the ongoing popularity of meme coins as investment vehicles.