Wall Street Reacts Strongly to Trump’s Venezuela Attack

Wall Street is reacting strongly to recent geopolitical developments following the capture of Nicolás Maduro, the Venezuelan president, by American forces. As traders returned to their desks for the first full trading day of 2026, rising U.S. equities were at the forefront of discussions, alongside accelerating mergers and acquisitions (M&A) activity.

Wall Street’s Focus Amidst Geopolitical Shifts

Andrew Woeber, Barclays’ global head of M&A, emphasized that CEOs and boards have adjusted to a landscape marked by volatility and unpredictability. “The risk now is to remain inactive and wait for ideal conditions,” he stated. Current indicators show no hesitation in deal-making despite recent geopolitical events.

Mergers and Acquisitions on the Rise

President Trump’s administration has fostered a renewed interest in mergers and acquisitions by advocating for a reduction in regulatory hurdles. The general sentiment on Wall Street reflects a more permissive approach from the Department of Justice and the Federal Trade Commission regarding mergers, especially concerning antitrust matters. However, contracts involving foreign investments are expected to face increased scrutiny to ensure national security.

- Global M&A volumes in 2025 were reported at $3.6 trillion.

- North America accounted for $2.2 trillion of that total.

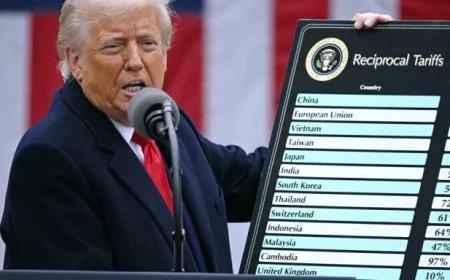

- Dealmaking faced a temporary slowdown in April 2025 due to newly imposed tariffs.

Despite challenges, deal-making has resumed, buoyed by an improved economic outlook. Woeber noted an ongoing wave of M&A activity, primarily driven by global companies bringing operations back to the U.S. This includes sectors relating to artificial intelligence, data centers, and industrial technology.

Market Response to Trump’s Policies

Trump’s actions continue to invigorate what some term Wall Street’s “animal spirits.” The Dow Jones Industrial Average reached a new high, spurred by Trump’s commitment to rejuvenating Venezuela’s crude production with support from American energy companies. Additionally, the number of initial public offerings (IPOs) in the U.S. rose towards the end of last year, signaling a lively market for new investments.

- Notable potential IPO candidates for 2026 include SpaceX, Anthropic, and OpenAI.

- Significant IPOs may be delayed until 2027.

Investment Opportunities in Venezuela

Charles Myers, chairman of Signum Global Advisors, indicated there has not been heightened concern among clients about further U.S. military actions in Venezuela escalating tensions with Russia or China. Instead, inquiries now revolve around possible U.S. actions involving Cuba and Greenland, with Trump asserting Cuba is “ready to fall.” Myers noted strong interest in investment opportunities in Venezuela and plans to visit the country with industry representatives. “We have overwhelming demand for participation,” he disclosed.