Trump Applies Private Equity Tactics to Venezuela Strategy

President Donald Trump’s approach to Venezuela reflects a strategy akin to private equity investments. The notion that Venezuela presents a profitable venture drives much of his administration’s actions regarding the nation.

Trump’s Business-Oriented Strategy

During a recent press conference, Trump emphasized the potential wealth hidden within Venezuela’s oil reserves. He claimed the country’s oil industry has significantly underperformed, stating, “The oil business in Venezuela has been a bust.” His focus on restructuring Venezuela’s oil infrastructure suggests a belief in its potential profitability.

Profiting from Venezuelan Assets

Trump’s tactics resemble those used by private equity investors who often target underperforming assets. He announced that U.S. oil companies would “fix” the infrastructure, implying they would profit from these efforts. Trump’s rationale for intervention is notably rooted in economic gain rather than political motives.

The Comparison to Iraq

In a conversation with Joe Scarborough, Trump starkly differentiated the current situation in Venezuela from the U.S. invasion of Iraq. He asserted that the U.S. would retain control of Venezuelan oil, highlighting a shift in strategy. “We’re going to keep the oil,” Trump reportedly stated, signaling a profit-driven agenda.

Investment Opportunities and Speculations

- A trader on a crypto-based platform, Polymarket, placed a $32,000 bet that Nicolás Maduro would be ousted by January, resulting in a $400,000 profit.

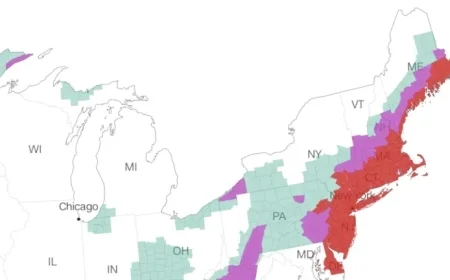

- Elliott Investment Management, a hedge fund led by Paul Singer, made a significant move by bidding on Citgo, Venezuela’s state-run oil refiner, for about $6 billion.

- The approval of this acquisition could lead to substantial financial gains if endorsed by the U.S. Treasury.

The Oil Industry’s Hesitation

Despite the perceived opportunities, the U.S. oil sector remains cautious. Venezuelan oil quality is relatively low, complicating extraction and refinement processes. Additionally, industry insiders have raised concerns about the political and economic climate.

Understanding the Risks

While there is potential in Venezuela’s oil assets, the real beneficiaries thus far appear to be investors and gamblers rather than American citizens. Experts warn that Trump’s rapid and profit-focused strategy reflects the risks inherent in such interventions. Daniel Weiner of the Brennan Center emphasizes the dangers of “gunboat diplomacy” that could foster self-dealing practices.

The future of Venezuela’s oil remains uncertain. However, if Trump’s strategies unfold as planned, they could reshape both the U.S. and Venezuelan economic landscapes.