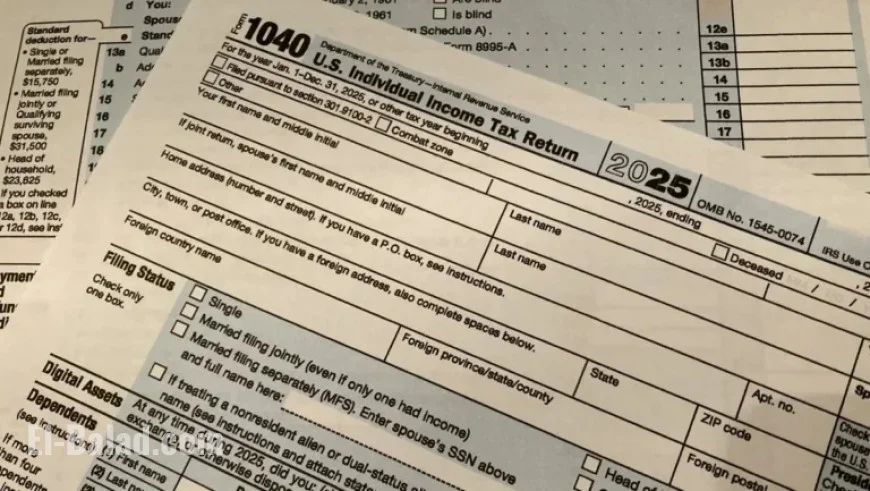

IRS Sets Start Date for 2025 Tax Return Submission

The Internal Revenue Service (IRS) has announced important dates and changes for the upcoming tax season. Taxpayers can expect several updates affecting their 2025 federal income tax returns, with new filing procedures and deductions in place.

Start Date for 2025 Tax Return Submission

The IRS has officially set the opening day for the 2026 filing season as January 26, 2026. Taxpayers will have until April 15, 2026, to submit their tax returns and any payments due.

Anticipated Changes for 2025 Returns

This upcoming tax season is expected to be complex due to numerous new tax breaks introduced by the One Big Beautiful Bill Act. Taxpayers should be aware of the changes that will affect their filings, including modifications to standard deductions and eligibility criteria for various credits.

Key Dates and Numbers

- Filing Start Date: January 26, 2026

- Filing Deadline: April 15, 2026

- Estimated Tax Returns: 164 million individual returns expected

- Electronic Filing: Most taxpayers are anticipated to file electronically

Changes in Refund Processing

Significantly, the IRS will transition away from issuing paper refund checks for most individual taxpayers, streamlining the refund process. IRS Chief Executive Officer Frank Bisignano stated that updated information systems will facilitate efficient handling of returns.

New Filing Requirements

Taxpayers planning to claim new deductions should familiarize themselves with the new Schedule 1-A. Notable deductions include:

- No tax on tips

- No tax on overtime earnings

- No tax on car loan interest

- Enhanced deductions for seniors

IRS Free File Program

The IRS Free File program will begin accepting tax returns from qualified taxpayers starting January 9, 2026. Additionally, from January 26, taxpayers can also use IRS Free File Fillable Forms, which is available regardless of income level.

Previous Filing Season Insights

During the early days of the previous filing season in 2025, the IRS had already processed over 13.1 million tax returns by January 31, with more than 3.2 million refunds issued, averaging around $1,928 each. The average federal tax refund for 2025 peaked at $3,052, reflecting a 1.6% increase from the previous year.

Overall, taxpayers should prepare for a busy and potentially intricate filing season ahead. The IRS is committed to assisting taxpayers in meeting their obligations, ensuring compliance amidst evolving tax laws.