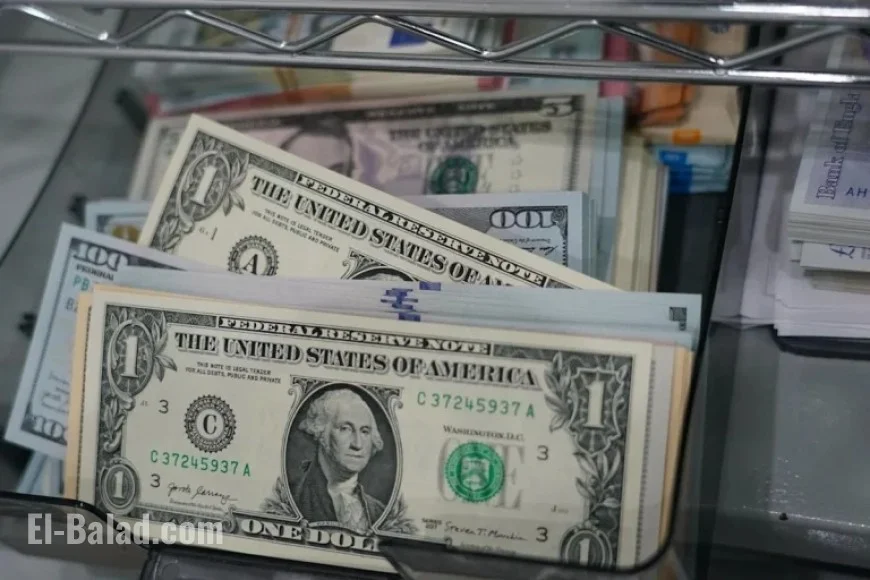

Dollar Rises Amid Trump Turmoil, Spotlight on Fed’s Future Moves

The current performance of the dollar is noteworthy, reflecting the resilience of the US economy amidst geopolitical challenges. Despite rising tensions influenced by former President Donald Trump, the currency has shown surprising strength. Traders had anticipated a drop in the dollar as the Federal Reserve considers cutting interest rates, potentially prompting investors to seek higher returns elsewhere.

US Economic Resilience Against Geopolitical Turbulence

Traders entered the new year with skepticism about the dollar, particularly due to Trump’s actions concerning Venezuelan leader Nicolás Maduro and his rhetoric targeting numerous countries. Investors expected these actions could destabilize the dollar, yet it continued to rise, reaching a one-month high.

Positive Employment Data Bolster the Dollar

Recent employment data points paint a complex picture of the US job market. The December jobs report revealed a surprising decline in the unemployment rate to 4.4%, despite nonfarm payroll growth of only 50,000, falling short of expectations of 70,000. Average hourly earnings also increased by 0.3%.

- Unemployment Rate: 4.4%

- Nonfarm Payroll Growth: 50,000 jobs

- Expectation for Nonfarm Payrolls: 70,000 jobs

- Hourly Earnings Increase: 0.3%

The Bloomberg Dollar Spot Index recorded its fourth consecutive daily advance, climbing 0.5% this week—the most significant gain since November. The dollar also achieved its highest value against the Japanese yen in one year.

Future Fed Moves and Market Predictions

The market now anticipates that the Federal Reserve may refrain from further interest rate cuts in the near term. Analysts attribute this to the persistent strength of the US economy and recent job market data. Wall Street experts foresee the dollar continuing its uptrend in the short term but caution against longer-lasting bearish trends as the Fed might still move toward lowering rates.

Speculative Market Dynamics

In recent weeks, speculation against the dollar increased by approximately $21 billion. This figure marks the largest bearish adjustment in a month since the pandemic began in March 2020. The dollar’s recovery is also attributed to rising Treasury yields, which have typically supported its strength.

Analysts from Citigroup and other institutions indicate that geopolitical factors may not outweigh economic growth, inflation, and corporate earnings as primary market drivers. The upcoming Supreme Court ruling regarding the legality of Trump-era tariffs is expected to further influence market sentiments.

Overall, despite geopolitical uncertainties, the dollar is primed for potential gains due to robust economic indicators and a possible shift in Federal Reserve policies. Investors will keenly watch upcoming developments for clear direction.