Rising ‘Gray Divorce’ Rates: How Couples Over 50 Can Stay Protected

Divorce rates among individuals over 50, commonly referred to as “gray divorce,” have become a significant trend in the United States. Currently, this demographic accounts for approximately 36% of all divorces. These separations involve complex financial issues and require careful planning to protect individual assets.

Understanding the Financial Impact of Gray Divorce

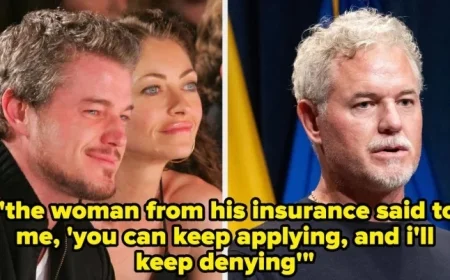

Older couples face unique challenges during a divorce, particularly related to long-term financial planning. Divorcing at this age often involves dividing substantial assets, including property and retirement accounts, which can complicate the separation process. For instance, one woman’s experience illustrates said complexities. At 53, she found herself overwhelmed by retirement funds, tax documents, and home ownership concerns.

Financial specialists, such as certified divorce financial analysts (CDFAs), are increasingly sought to navigate the intricacies of gray divorce. Their services have become more important as the divorce rate among those 50 and older has nearly doubled since the 1990s. The number of certified divorce financial analysts has surged by approximately 40% over the past decade, now totaling about 3,500 professionals across the country.

The Struggles of Older Divorcing Couples

The financial repercussions following a gray divorce can be significant. Research indicates that women’s standard of living decreases by roughly 45% post-divorce, while men experience a 21% decline. Factors contributing to this disparity often include time spent out of the workforce for raising children or caregiving, which results in lower retirement savings and Social Security benefits.

Financial Protection Strategies for Older Divorcing Couples

For those facing divorce later in life, understanding and managing finances is critical. Here are key steps to consider:

- Comprehensively assess both joint and individual accounts, including bank, retirement, and insurance policies.

- Create separate checking or savings accounts and start building a small emergency fund.

- Analyze different scenarios for dividing assets and the future income needed.

It may also be beneficial for individuals married for at least ten years to know that they can claim Social Security based on their ex-spouse’s earning record, which can significantly enhance their financial position without impacting the ex-spouse’s benefits.

Housing and Long-Term Financial Planning

Many people view their home as a crucial asset post-divorce. However, the costs associated with maintaining a property alone can be burdensome. Renting or downsizing might be wise alternatives to explore.

To navigate the financial landscape after a gray divorce successfully, consider collaborating with a financial planner. They can provide insights into budgeting, retirement savings, and the implications of various decisions. Understanding these elements is vital for ensuring long-term financial stability.

Preparing for the Future

Divorce after 50 can redefine one’s financial future. Older adults should prioritize getting a clear picture of their finances, building independence, and planning for retirement. Proactive measures taken now can position individuals favorably to handle unforeseen life changes.