Understanding the Debt Crisis Dynamics in G10 Nations

Concerns over debt crises are intensifying among G10 nations, particularly as high public debt levels threaten economic stability. Central banks have historically maintained credibility, allowing them to manage bond yields without risking inflation. However, this perception may overlook significant risks associated with growing debt levels.

Understanding the Debt Crisis Dynamics in G10 Nations

High public debt often leads to increased yields as markets predict larger deficits and more debt accumulation. When central banks artificially suppress yields, they may inadvertently discourage governments from addressing public debt, pushing central banks deeper into fiscal dominance. This dynamic can eventually destabilize inflation expectations.

Potential Consequences of Yield Suppression

- Central banks face challenges in maintaining currency value while capping bond yields.

- Suppressed risk premiums in the bond market can manifest as a depreciated currency.

- This cycle can lead to a deterioration of economic fundamentals, paving the way for debt crises.

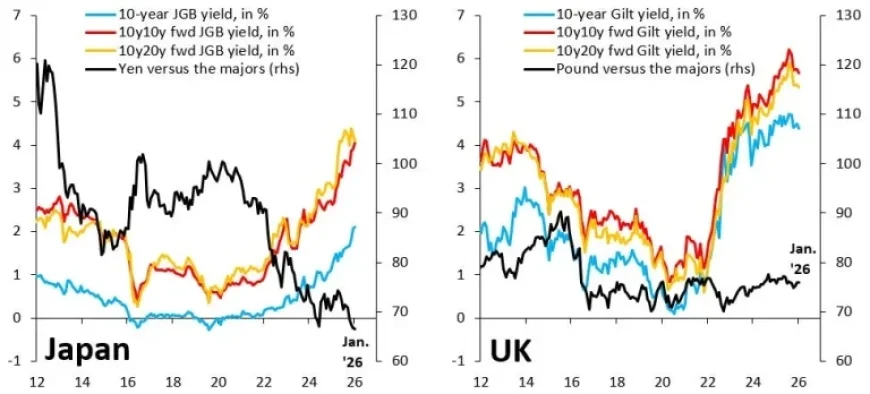

Evidence of low-grade debt crises is already visible in several G10 nations. For instance, an analysis of the Japanese Yen shows a steep decline in its value against other currencies, even as yields on Japanese Government Bonds (JGBs) reach record highs. This situation signals mounting risks for Japan’s financial stability.

Comparison of Japan’s and the UK’s Economic Situations

The Bank of Japan is currently engaging in substantial purchases of JGBs to cap yields. Consequently, this strategy is reflected in currency valuation, with the Yen depreciating significantly. In contrast, the UK’s approach has allowed risk premiums to manifest, resulting in comparatively stable currency valuations despite rising Gilt yields. However, the underlying pressure from higher yields remains a common issue.

Emerging Risks in Europe

Beyond Japan and the UK, several countries within the Eurozone, including Italy, Spain, and France, face increasing pressure. Their challenges largely stem from high debt levels, exacerbated by shared currency dynamics with Germany. Although Germany’s comparatively low debt has provided temporary stabilization for the Euro, there are signs that Germany may also expand its deficits, hinting at potential instability within the Eurozone.

Conclusion: The Reality of Debt Crises in G10 Nations

The situation in G10 economies illustrates that debt crises are not only possible but are already unfolding. Policymakers must recognize these dynamics to prevent further deterioration of financial stability across advanced economies.