Japan Faces Economic Crisis – Insights from Robin J. Brooks

Japan is currently facing a significant economic crisis as the Yen approaches its lowest values against the US Dollar since 2024. This decline in the Yen’s value is notable in trade-weighted terms, where it has depreciated even more, given that the dollar is weaker than it was during 2024.

Potential Government Intervention

The Japanese Ministry of Finance (MoF) is hinting at possible official intervention to halt the Yen’s downward trajectory. However, previous attempts have proven ineffective. The core issue affecting the Yen’s value is the prevailing low interest rates, which do not sufficiently incentivize investors amid heightened concerns about default risks.

Interest Rates and Economic Stability

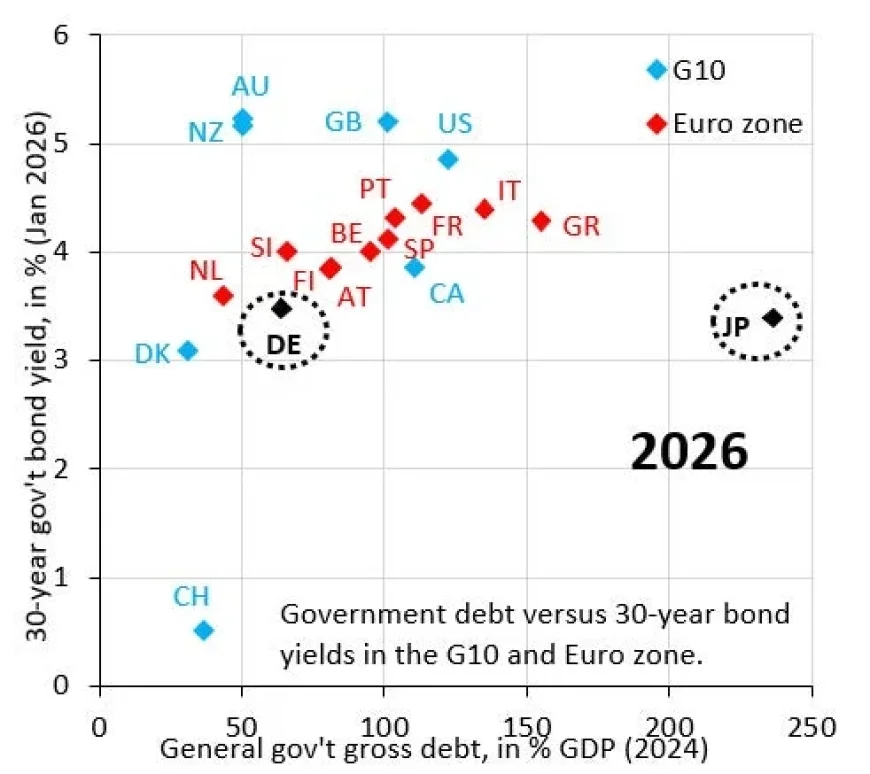

While raising interest rates could stabilize the Yen, such a move carries the risk of triggering a fiscal crisis. Japan is entangled in a complex economic situation. Recent data illustrates this concern: the nation’s gross government debt is starkly high, yet its 30-year government bond yields remain relatively low.

Debt Comparison: Japan vs. Germany

When comparing Japan to Germany, the differences become evident. Germany’s debt is substantially lower than Japan’s, but its 30-year bond yield exceeds that of Japan. Ongoing purchases of government debt by the Bank of Japan (BoJ) keep Japan’s yields artificially suppressed. This situation contributes to ongoing depreciation of the Yen, regardless of any official foreign exchange interventions.

The Risks of Rising Yields

Allowing bond yields to increase is a double-edged sword. If yields rise too much, Japan may plunge into a deeper fiscal crisis. The BoJ’s continued bond purchases are essential to maintain stability, as the potential for yield hikes remains uncertain.

A Possible Solution for Japan’s Debt Crisis

Despite the grim outlook, there is a viable strategy for Japan. The government’s net debt is significantly lower than its gross debt due to the substantial assets it holds. A sound approach would be to sell some of these assets to reduce gross debt levels.

- Net debt: 130% of GDP

- Gross debt: approximately 240% of GDP

Although much of Japan’s assets are illiquid and cannot be quickly sold, even a small step towards asset liquidation could greatly impact the Yen’s value positively. This path may prove more effective than engaging in futile official foreign exchange interventions.