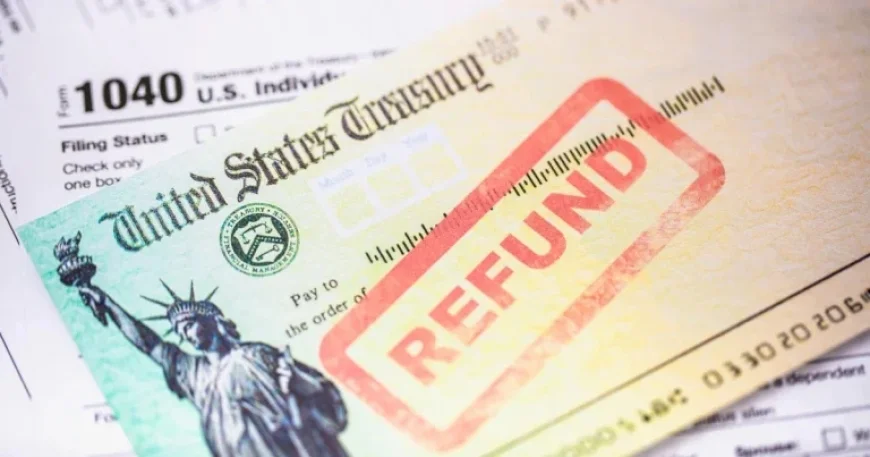

New $6,000 Senior Tax Deduction Impacts Millions of Americans Over 65

A new tax deduction of $6,000 for Americans aged 65 and older is set to provide significant financial relief. This deduction could result in an average increase of $670 in tax refunds for millions of eligible seniors. According to research by AARP, those in the 22% tax bracket may even save up to $1,320, enhancing their financial stability during challenging times.

Overview of the $6,000 Senior Tax Deduction

The new deduction, which will be available starting in the 2025 tax season, is part of a broader tax measure implemented by Republican lawmakers. It is expected to run until 2028, allowing seniors to benefit from this relief for a prolonged period.

Key Benefits and Eligibility

- Average refund increase: $670

- Potential maximum savings: $1,320 for qualifying seniors in the 22% tax bracket

- Eligibility: Must be 65 or older by December 31, 2025

- Deduction amount: $6,000 for individuals; $12,000 for married couples

Income Limits

The deduction is subject to specific income thresholds. Single filers aged 65 and over can claim the full deduction if their modified adjusted gross income is under $75,000. Married couples must have an income below $175,000 to qualify for the full $12,000 deduction. If income exceeds these limits, the deduction reduces by six cents for every dollar over the threshold, phasing out completely at $175,000 for singles and $250,000 for couples.

How the Deduction Works

The $6,000 deduction is available to both itemizers and those who opt for the standard deduction. The standard deduction is currently $15,750 for singles and $31,500 for married couples. When combined, seniors can potentially claim:

- Total for single filers: $23,750

- Total for married couples: $46,700

Implications for Social Security Income

It’s important to note that this deduction does not specifically apply to Social Security income. However, it helps lower overall taxable income, allowing seniors to retain more of their earnings. According to experts from H&R Block, those who haven’t begun receiving Social Security benefits may still qualify for the $6,000 deduction.