Trump Targets Wall Street’s Profit Aims with Affordability Pledge

President Donald Trump has recently proposed a cap on credit card interest rates, aiming to set it at 10% for one year. This initiative surfaces amid ongoing discussions surrounding affordability and could potentially create tension with Wall Street.

Impact on Affordability and Economy

The proposed interest rate cap is designed to provide immediate relief to consumers burdened by high credit costs. However, industry experts express concern that it may not address the underlying issues affecting affordability. Mark Mason, CFO of Citigroup, warned that such a cap could limit credit access, particularly for those who need it most, potentially stunting economic growth.

Advocates of reform argue that companies have been excessively profiting from high interest rates. According to Brian Shearer, director at the Vanderbilt Policy Accelerator, a cap could save American consumers tens of billions annually. “People are paying attention to the excessive charges by banks,” Shearer noted.

Context of the Proposal

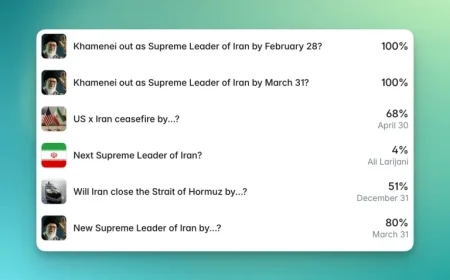

The 10% interest rate cap is part of Trump’s larger strategy as the US midterm elections approach. Currently, the average credit card interest rate stands at 19.64%, a significant burden on American households. Discussions about similar caps have occurred in the past, with various lawmakers, including Senators Bernie Sanders and Josh Hawley, proposing different interest rate limits.

Challenges to Implementation

- Legislative action is required for the cap to take effect, needing Congressional approval.

- Voluntary compliance from credit card issuers is essential for the proposal to succeed.

Former Senator Pat Toomey has criticized the proposal, labeling it an “old and misguided idea.” He emphasized that limiting interest rates could result in reduced credit availability for consumers.

Industry Response

Major banks, including Bank of America, have expressed their opposition to the proposed cap. Brian Moynihan, CEO of Bank of America, indicated that imposing a lower cap would restrict credit access. Similarly, Jane Fraser, CEO of Citigroup, stated that the bank could not support a rate cap.

As of the third quarter of 2023, US households held approximately $1.23 trillion in credit card debt, marking a 5.75% increase from the previous year. This substantial debt underscores the urgency of affordability reform.

Potential Benefits and Drawbacks

Researchers like Shearer project that capping interest rates could save consumers around $100 billion annually. However, there could be a trade-off; with reduced rewards in loyalty programs, consumers with lower credit scores may lose out on approximately $27 billion in perks. Yet, even with these reductions, the overall savings in interest could surpass the loss of rewards.

Broader Implications

- Proponents of reform agree the cap would not significantly threaten bank profitability.

- Concerns remain that Trump’s previous deregulations could undermine these efforts.

Experts warn that Trump’s historical record on financial regulation contradicts his current stance on interest rates. Critics argue that focusing on less impactful measures, such as capping late fees, may prove more effective. Rohit Chopra, a former consumer protection bureau director, expressed doubt regarding Trump’s commitment to following through with substantial reforms.

In conclusion, while Trump’s proposed cap on credit card interest rates aims to alleviate consumer burdens, it faces significant skepticism from industry leaders and experts alike, raising questions about its potential effectiveness and implementation. The debate continues as affordability remains a pressing issue for many Americans.