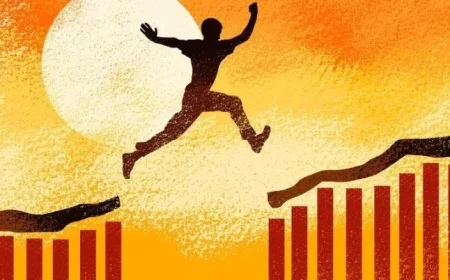

U.S. Dollar Collapse Alert: Markets Prepare for Gold and Bitcoin Price Shocks

The recent fluctuations in cryptocurrency and precious metal markets have raised significant concerns among investors. With the U.S. dollar facing pressures from geopolitical tensions and shifting economic indicators, both gold and Bitcoin are positioning themselves for potential price shocks.

U.S. Dollar Decline and Market Reactions

Recent statements from U.S. President Donald Trump regarding tariffs on NATO allies have compounded stress on the U.S. dollar. Following these announcements, the Dollar Index fell sharply, trading below 99.00 after peaking at a six-week high. This decline has had a direct impact on gold and Bitcoin prices, leading to market volatility.

Bitcoin Price Fluctuations

Bitcoin experienced a dramatic drop overnight, falling from nearly $96,000 to over $90,000. Analysts suggest that this decline is in response to the ongoing trade war and its effects on investor sentiment. Speculation around Bitcoin’s value continues, especially as traders monitor international developments closely.

Gold Achieves Record Highs

Conversely, gold prices have surged, reaching new all-time highs amidst the dollar’s weakness. Analysts predict that prices could escalate further, with BNP Paribas’ David Wilson hinting at a target of $5,000 per ounce. This increase in gold prices reflects investor behavior as they seek safety in precious metals during uncertain times.

Inflation and Economic Concerns

- Economists at Barclays and Morgan Stanley forecast higher inflation rates for the U.S. personal consumption expenditures price index (PCE) in December, predicting increases to 2.8% or 2.9%.

- The Consumer Price Index (CPI) from the previous week reported at 2.7%, suggesting a rising trend in inflation.

- Investor Peter Schiff has warned of a potential dollar collapse, linking it to soaring consumer prices and unprecedented stagflation, where economic growth stagnates amidst rising prices.

The release of the upcoming PCE data is expected to heighten concerns surrounding stagflation. Traders are preparing for possible shocks in the market as the economic landscape shifts.

Future Outlook for Gold and Bitcoin

As uncertainty lingers around geopolitical events, traders are evaluating the potential for further declines in Bitcoin prices. Experts suggest that unless significant buying occurs, Bitcoin might continue to face downward pressure, with strong support levels estimated around $88,000. Meanwhile, the outlook for gold remains optimistic as investors flee to safer assets.

The ongoing tensions and economic indicators imply that the U.S. dollar may continue on its downward trajectory, prompting further reactions in Bitcoin and gold prices. Investors remain vigilant, aware that the market dynamics could shift rapidly as new data emerges.