Netflix Converts Warner Bros. Offer to All-Cash Deal

Netflix has officially transformed its previous offer for Warner Bros. Discovery (WBD) into a full cash proposal, now valued at $27.75 per share. This strategic shift eliminates the previously included stock component of $4.50 in Netflix shares, making the offer entirely cash-based.

Details of the Revised Netflix Offer

On Tuesday, Netflix announced that this new all-cash offer aims to enhance its competitiveness against Paramount’s existing $30 per share bid. The modification in Netflix’s strategy is anticipated to heighten the competition with Paramount, which has claimed its offer is superior.

Impact on Discovery Global

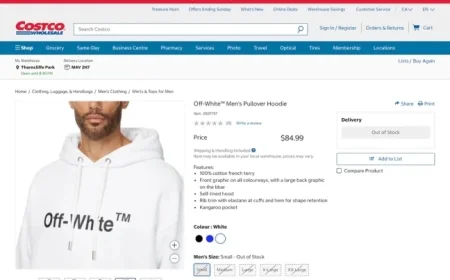

The adjusted offer also emphasizes Discovery Global’s potential as a standalone company, likely becoming a critical factor in determining the value of bids for WBD. The valuation of Discovery is essential, with estimates suggesting a range between $1.33 and $6.86 per share. Warner Bros. Discovery’s proxy filing revealed these valuations based on various financial analyses.

- Implications of Different Valuations for Discovery Global:

- Selected public companies analysis: $1.33 to $3.24 per share

- Sum-of-the-parts analysis: $2.41 to $3.77 per share

- Selected transactions analysis: $4.63 to $6.86 per share

Paramount’s Position and Legal Maneuvers

Paramount has contended that Discovery’s value could be as low as $0 to $0.50 per share, primarily through comparisons with past stock performance. Recently, David Ellison, CEO of Paramount, took legal action aimed at collecting more data regarding WBD’s asset valuation amid growing uncertainties around the bidding process.

Future Steps for Warner Bros. Discovery

A special shareholder meeting is scheduled to discuss this deal, which has yet to have a fixed date. If Paramount proceeds with a proxy battle, it must persuade shareholders to block Netflix’s proposal.

Statements from Executives

Following the revision of the offer, David Zaslav, President, and CEO of WBD, emphasized that this merger would enhance storytelling capabilities globally. Ted Sarandos, co-CEO of Netflix, stated that the all-cash offer not only accelerates shareholder voting but also reaffirms Netflix’s commitment to enhancing consumer choice and expanding market reach.

Netflix’s co-CEO, Greg Peters, reiterated the company’s track record of growth over the past decade, asserting that the revised agreement signifies not just financial advantages for shareholders but also benefits for consumers, creators, and overall industry growth.

Samuel A. Di Piazza, Jr., Chair of the WBD Board of Directors, affirmed that the all-cash consideration addresses shareholders’ interests, underscoring the opportunity for realizing the full potential of Discovery Global’s brands.