Federal Funding, CDL Rules, and Capacity Signals Reshape 2026 Freight Market

The freight market is evolving rapidly as it faces new regulations and funding initiatives from the U.S. government. Key developments indicate that 2026 will bring a freight environment characterized by tighter regulations and infrastructure demands.

Federal Funding Initiatives and CDL Regulations

On December 30, 2025, the U.S. Department of Transportation (DOT) allocated over $118 million in grants through the Federal Motor Carrier Safety Administration (FMCSA). This funding aims to enhance oversight, enforcement, and training related to Commercial Driver’s Licenses (CDL). Transportation Secretary Sean P. Duffy announced this initiative to improve safety standards and keep unqualified drivers off the roads.

- Increase in CDL oversight and training.

- Mixed implications for shippers regarding driver availability.

- Fed on compliance and safety as essential to freight planning.

David Stone, director of transportation at WSI, emphasized the urgent need for shippers to adapt to these changes, indicating that safety and compliance have become foundational components in freight capacity availability.

Regulatory Scrutiny of State CDL Programs

In addition to funding, the DOT is expected to examine state-level CDL programs more closely. There are indications that noncompliance may result in funding withdrawals at the state level, creating additional uncertainty for the trucking industry. Stakeholders express concern about uneven enforcement across different states, potentially leading to regional discrepancies in driver availability.

Freight brokers will be essential in navigating these challenges. They can provide real-time data and adaptive strategies to help shippers adjust to rapid regulatory changes.

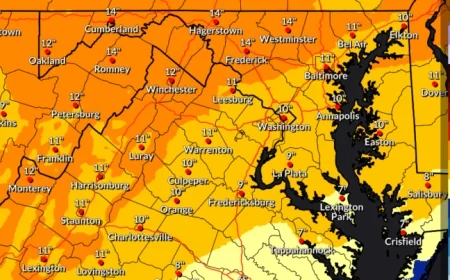

Infrastructure Development and Roadway Safety Funding

Shortly before the CDL funding announcement, the DOT also revealed nearly $1 billion for roadway safety improvements through the Safe Streets and Roads for All (SS4A) program. This investment will fund 521 projects across 48 states, tribal communities, and Puerto Rico.

- Focus on reducing serious injuries and fatalities.

- Projects include intersection redesigns and cyclist safety improvements.

Despite the long-term advantages of infrastructure improvements, short-term disruptions during construction may create temporary challenges for shippers, potentially leading to unpredictable transit times.

Capacity Constraints in the Freight Market

As regulatory pressures mount, the U.S. trucking market shows signs of tight capacity. According to recent reports, equipment orders, including Class 8 sleeper tractors and dry van trailers, have significantly decreased. This slowdown reflects a decrease in fleet expansion potential, even amidst varying demand.

- Historical lows in equipment orders, particularly for:

- Class 8 sleeper tractors.

- Dry van trailers.

- Refrigerated trailers.

The decline in available equipment means fewer options for carriers during peak demand. Consequently, shippers face heightened exposure to market volatility and inconsistencies in service reliability.

Opportunities in Cross-Border Freight

Despite domestic capacity challenges, cross-border freight between the U.S. and Mexico has surged, with exports from Mexico rising approximately 15% recently. This increased activity helps stabilize the overall trucking market, although it also introduces added complexities in customs and security compliance.

To mitigate potential disruptions, shippers are advised to plan for alternative logistics strategies, including various routing and contingency measures.

The Evolving Role of Freight Brokerage

Given the interplay of regulatory changes and capacity constraints, the role of freight brokers is shifting toward a more strategic function. Modern brokers now provide:

- Scenario-based capacity planning.

- Access to a compliant and vetted carrier network.

- Adaptive routing strategies for ongoing disruptions.

- Real-time market and regulatory intelligence.

Stone warns that shippers relying on static strategies are vulnerable in this rapidly changing environment. Flexibility and insight will be critical for maintaining service levels as conditions fluctuate.

Looking Ahead to 2026

The federal government’s investments in safety and infrastructure signal a commitment to enhancing the transportation system. However, as 2026 approaches, shippers must navigate a freight landscape marked by increased regulation and complexity. Adapting transportation strategies centered on compliance and expert support will be essential to successfully meeting future challenges.