IRS Tax Returns: Key Deadlines and Start Date Revealed

As the 2025-2026 tax season kicks off this month, taxpayers are facing a critical time frame that will impact their financial status for the upcoming year. With the first day to file taxes approaching on January 26, it is essential to grasp the changes in tax laws and new benefits emerging from the One Big Beautiful Bill Act signed into law this past year. Understanding these elements can make filing smooth and potentially more advantageous for a multitude of taxpayers.

New Tax Brackets and Filing Details for 2025-2026

The IRS has updated tax brackets for the 2025-2026 season, altering the landscape for millions of individuals. While the specifics of the new brackets can often dictate tax liabilities, the changes serve multiple purposes, from adjusting for inflation to providing incentives for certain demographics. For instance, taxpayers aged 65 and over are eligible for a standard deduction increase, a move that signals an ongoing recognition of the financial realities facing seniors.

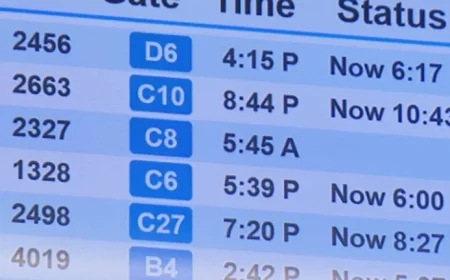

The 2026 tax filing deadline is set for April 15. Filing earlier not only expedites the return process—allowing taxpayers to receive their refunds within 21 calendar days if their return is error-free—but also facilitates financial planning for those anticipating refunds to manage upcoming expenses. Furthermore, taxpayers can file for a six-month extension, providing additional flexibility in managing their financial affairs.

A Closer Look at New Tax Breaks

The One Big Beautiful Bill Act has introduced various retroactive tax breaks effective from January 1, 2025. Key highlights include:

- $6,000 deduction for individuals aged 65 and older.

- No taxes on tips, with a maximum deduction of $25,000.

- No taxes on “qualified” overtime, allowing a maximum deduction of either $12,500 or $25,000 for joint filers.

- No taxes on car loan interest, with a maximum annual deduction of $10,000.

- Expansion of health savings accounts and an adoption credit of up to $5,000.

This suite of abatement measures indicates a broader government strategy to alleviate fiscal pressures on specific segments of the population, particularly during a time of economic instability. The intent behind these adjustments is twofold: stimulate consumer spending while easing specific financial burdens that the low and middle classes experience.

| Stakeholder | Before | After | Impact |

|---|---|---|---|

| Individuals 65+ | Standard deduction: Regular rates | Standard deduction increases by $6,000 | Higher refund potential |

| Gig Workers | Subject to tax on tips | No tax on tips up to $25,000 | Increased take-home income |

| Families with Adoptions | Minimal tax credits | Adoption credit increased to $5,000 | Improved financial support |

Documentation and Filing: Essential Steps

Before taxes can be filed, adequate documentation is required. Key forms include the Form 1040, W-2, various 1099 forms for freelancers and gig workers, and student loan-related documents. Each document offers a distinct insight into a taxpayer’s financial situation, critical for minimizing liabilities and maximizing credits.

IRS Online Account Setup

Creating an IRS online account facilitates easier tracking and management of tax documents and updates. Taxpayers can access their significant tax details, view notices, and manage payment plans effortlessly via this platform. This capability becomes increasingly relevant as individuals seek efficiency in navigating the complex tax landscape.

Projected Outcomes and Strategic Insights

Looking ahead, here are three critical developments to monitor as we delve deeper into the tax season:

- Increased Compliance Rates: The new breaks may incentivize more taxpayers to file, reducing instances of evasion.

- Economic Impacts of Refunds: Quick refunds may bolster consumer spending, aiding economic recovery efforts and stimulating local businesses.

- Further Legislative Changes: Upcoming debates surrounding tax reform could yield additional modifications aimed at enhancing equity within the tax system.

Navigating the 2025-2026 tax season requires proactive involvement and awareness of these changes. As taxpayers prepare for upcoming deadlines, understanding the implications of new tax rules will prove critical in optimizing their financial landscape.