Essential Insights on Gold: What You Need to Know

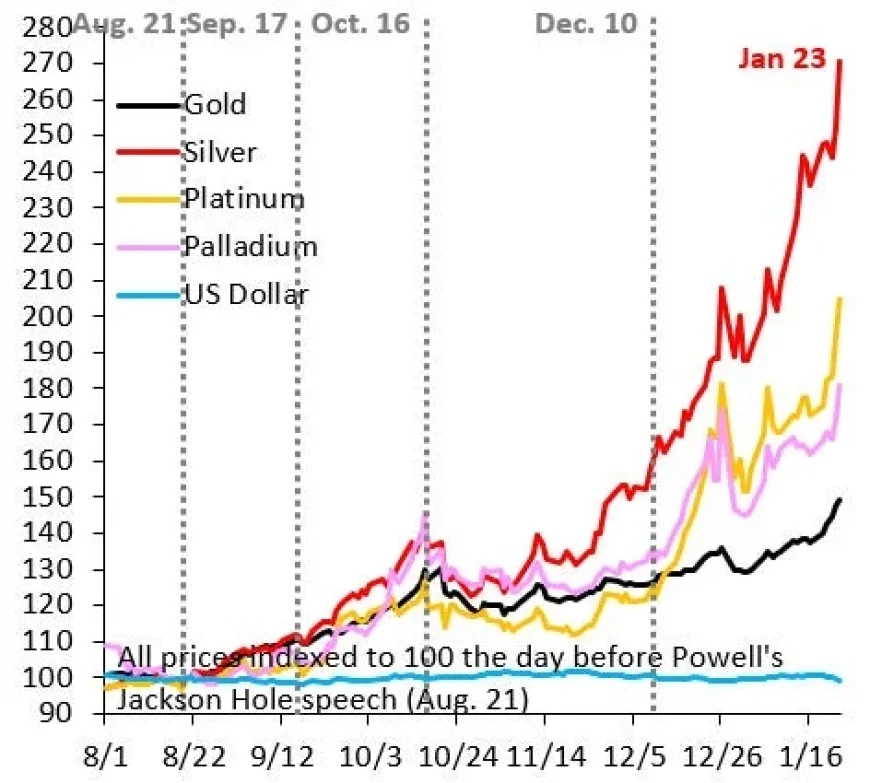

The surge in precious metals, especially gold, has attracted significant attention recently, with prices climbing steeply. Since August 22, gold prices have increased by 50%. This trend began after Federal Reserve Chair Jerome Powell’s dovish address at the Jackson Hole symposium, signaling the onset of what analysts are calling the “debasement trade.” Understanding this phenomenon is crucial in today’s economic landscape.

Understanding the Factors Driving Gold Prices

Several interconnected factors are contributing to the current rise in gold and other precious metals.

Global Debt Crisis

- The increase in gold prices is indicative of a broader global debt crisis.

- High-debt countries, such as Japan, are facing extreme pressure in their government bond markets.

- Investors are fleeing to safer economies like Sweden, Norway, and Switzerland.

This flight to safety highlights a growing concern among investors regarding governmental efforts to manage unsustainable levels of debt through inflationary measures.

Central Bank Activity

- Contrary to speculation, central bank buying is not the primary driver of rising gold prices.

- Evidence indicates that central banks are purchasing gold at a steady pace, rather than in a frenzied manner following recent geopolitical events.

- There has been no significant uptick in gold purchases after Russia’s invasion of Ukraine in February 2022.

While some countries, including China, may conceal their gold buying activities, it is unlikely that these actions are responsible for the current market surge.

Speculative Bubble Dynamics

The recent gold price surge resembles a speculative bubble, primarily fueled by retail investors. Historical trends show that gold typically depreciates when real interest rates rise. However, this correlation appears to be breaking down amidst current economic uncertainties.

Impact of Dollar Performance

- The declining value of the U.S. Dollar is expected to exacerbate the rise in gold prices.

- The Dollar started poorly in 2026, which aligns with predictions of renewed Dollar weakness.

- Falling Dollar values increase purchasing power for non-Dollar-based buyers, further driving demand for gold.

As the debasement trade evolves, it is anticipated that these market dynamics will accelerate, impacting investors globally.

Conclusion

In summary, the rise in gold prices is influenced by a combination of factors, including global debt levels and central bank behaviors. A speculative bubble, driven by retail investors, also plays a significant role. As the Dollar weakens, the impact on gold prices is likely to be profound, underscoring the need for investors to stay informed about these developments.