Wall Street Plans 24/7 Operations for Continuous Trading

The New York Stock Exchange (NYSE) is on the brink of introducing 24/7 trading, pending the necessary approvals from federal regulators. This significant development comes from the Intercontinental Exchange, which is rolling out a platform designed for continuous operations. The new system promises “instant settlement” and will utilize digital tokens reflecting the shares of listed companies.

24/7 Operations and Approval Process

The shift to round-the-clock trading is anticipated to revolutionize financial transactions in the U.S. stock markets. However, the initiative requires the endorsement of the U.S. Securities and Exchange Commission (SEC). Should NASDAQ choose to follow suit, it may also introduce similar measures this year.

The Evolution of Trading

Historically, trading on Wall Street involved physical presence and manual transactions. Investors would shout and wave paper slips to execute trades, a method that is now outdated. Sam Burns, chief strategist at Mill Street Research, notes that digitized transactions can facilitate a continuous trading environment that was previously impractical.

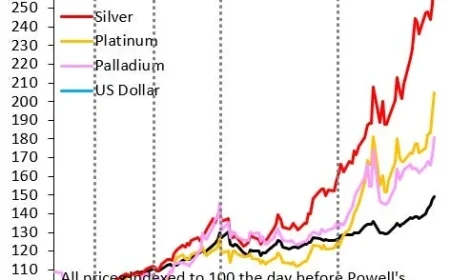

Rising Demand for Off-Hours Trading

Off-hours trading has gained momentum since 2019, with daily averages surpassing $61 billion in early 2025. Despite this growth, some experts, such as Steve Hanke from Johns Hopkins University, question the benefits of 24/7 trading. He argues that there is limited evidence supporting the idea that continuous trading would yield significant advantages over traditional hours.

Potential Advantages and Market Appeal

- The NYSE aims to shorten the trade settlement process, providing a competitive edge.

- Extended trading hours could attract a younger demographic and international investors.

- As of 2024, nearly 18% of U.S. shares were held by non-U.S. investors.

The appeal of around-the-clock trading particularly resonates with younger investors who are accustomed to the flexibility of cryptocurrency markets. However, traditional institutional investors may remain disengaged, preferring to trade during standard business hours. This hesitation is largely due to the fact that banks typically close on weekends.

As the NYSE prepares for this potential transition, the outcomes remain uncertain. The future of trading on Wall Street may see a significant transformation, pushing boundaries to adapt to a new generation of investors.