Premarket: U.S. Stock Futures Dip Amid Big Tech Results, Fed Decision Looms

The Canadian stock market reached a new record high recently, driven by soaring precious metals prices. This surge in mining shares has overshadowed trade uncertainties stemming from the U.S. administration’s tariff threats. The S&P/TSX Composite Index climbed 93.88 points to close at 33,238.66, marking a 0.28% gain.

Market Overview and Key Influencers

Gold miners led the gains, rising 4% as gold prices increased by 2.1%, briefly surpassing $5,100 per ounce. Silver prices also rallied, showing an impressive 8.2% rise. The broader materials index grew by 3.9%, reflecting strong market performance.

Concerns Over Sustainability

Despite the positive trends, analysts caution that the current rally in gold may not be sustainable. Colin White, CEO of Verecan Capital Management, noted that continued increases in gold could disrupt other market sectors, leading to a potential resistance point against treasuries and equities.

Trade Tensions and Economic Outlook

Recent trade tensions have intensified following U.S. President Donald Trump’s threat of imposing a 100% tariff on Canada if the country proceeds with a trade deal involving China. In response, Prime Minister Mark Carney reaffirmed Canada’s commitment under the USMCA agreement, maintaining that Canada will not seek free trade agreements with non-market economies.

This week, the Bank of Canada is expected to announce its interest rate decision. Economists surveyed by Reuters project that the Canadian economy will continue to grow steadily, anticipating no changes in policy rates through 2026.

Corporate Highlights

- Bombardier: Shares dropped by 7% following a twin-engine jet crash in Maine with eight individuals aboard.

- Baker Hughes: The company’s stock rose by 3.6% after reporting a stronger-than-expected profit.

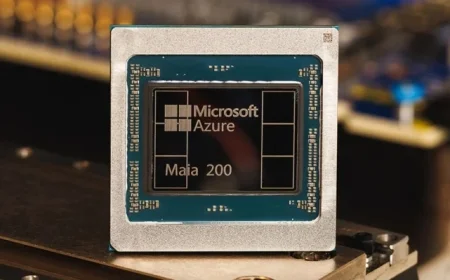

- CoreWeave: Increased by 12.8% following Nvidia’s $2 billion investment to enhance AI factory construction.

- USA Rare Earth: Jumped 19% after securing $277 million in government support for producing rare earth minerals.

U.S. Stock Market Trends

U.S. stocks exhibited slight gains on the same day. The S&P 500 increased by 0.4%, rebounding from prior losses. Both the Dow Jones Industrial Average and the Nasdaq composite rose by 0.3% and 0.4%, respectively.

Upcoming Economic Indicators

The U.S. Federal Reserve is set to announce its next interest rate decision on Wednesday. Analysts predict that the Fed will maintain its current rates, as inflation rates remain above the 2% target. This decision follows ongoing interest rate cuts aimed at strengthening the job market.

As the week unfolds, significant earnings reports are expected from major tech companies, including Meta Platforms, Microsoft, Tesla, and Apple. These developments, combined with fluctuating market conditions, suggest that investors should remain vigilant.

Foreign Exchange and Global Markets

In the foreign exchange market, the U.S. dollar has continued to weaken against other currencies, particularly the Japanese yen. Speculation regarding potential interventions from both Japan and U.S. officials could influence dollar value moving forward.

In global markets, European indexes saw minor increases, while Japan’s Nikkei 225 faced notable declines, dropping by 1.8%. This downturn could impact Japanese exporters like Toyota, which fell by 4.1%.