Reasons Behind the Dollar’s Decline

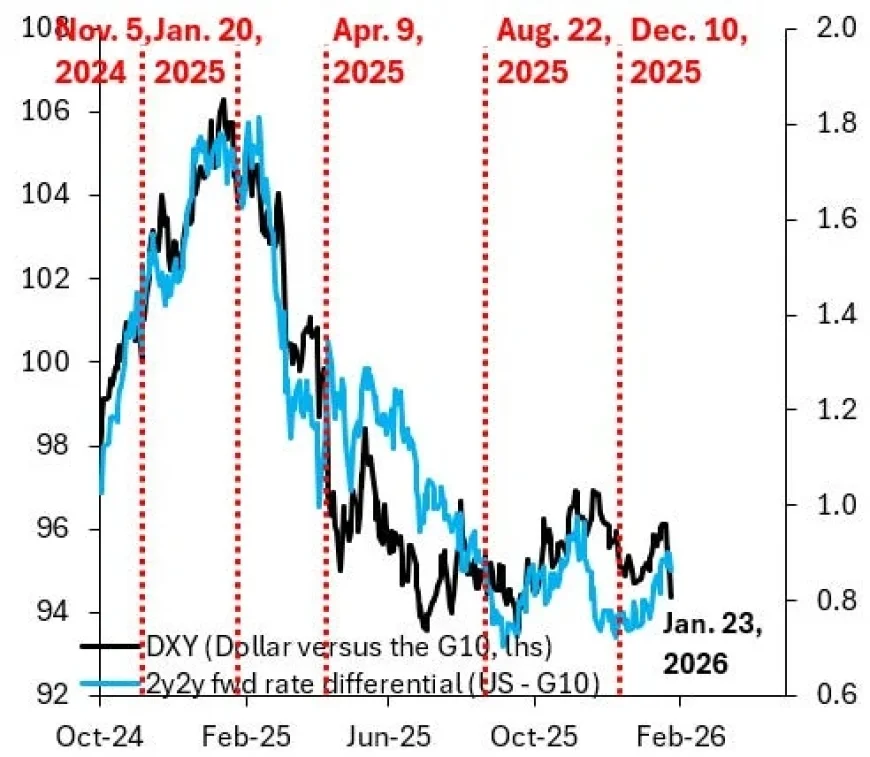

The recent decline of the US Dollar has caught the attention of market analysts, suggesting that we may be witnessing a significant shift in currency dynamics. There are several key factors driving this trend, including policy chaos, market complacency, and foreign flows into US assets.

Reasons Behind the Dollar’s Decline

1. Policy Chaos and Market Reaction

Political events often shape market sentiment. In April 2025, the introduction of reciprocal tariffs led to a sudden drop in the Dollar. This decline was attributed to increased tensions, especially in relations with China, which markets perceived as chaotic and harmful to US interests.

Currently, the Dollar is experiencing a similar downturn amidst the government’s handling of issues related to Greenland. Market reactions indicate skepticism regarding US policy, with a notable decline in the 2-year interest rate differentials, mirroring the scenario from 2025.

2. Market Complacency

Despite warnings of potential Dollar weakness, many investors have grown complacent. The stabilization of the Dollar in late 2025 led to diminished concerns about its future performance. Data from the CFTC’s weekly Commitment of Traders report revealed that positions on the Dollar against major currencies had flattened, indicating a belief that the Dollar would remain stable.

This complacency may now reverse, as recent market actions signal increased uncertainty. The expectation is that the Dollar may see a prolonged decline moving forward.

3. Foreign Investment Dynamics

Inflow of foreign investments into US assets remains robust. However, these inflows are small compared to the overall stock of assets held by foreigners. Economic confidence is critical; if it falters, foreign investors might hedge their investments by selling the Dollar forward in currency markets, even if they retain their US assets.

This behavior was evident last week and echoes the patterns observed in April 2025.

Conclusion

In summary, the intersecting factors of policy uncertainty, market complacency, and foreign investment behavior contribute significantly to the ongoing decline of the Dollar. As the economic landscape evolves, careful attention will be required to understand and navigate these complexities.