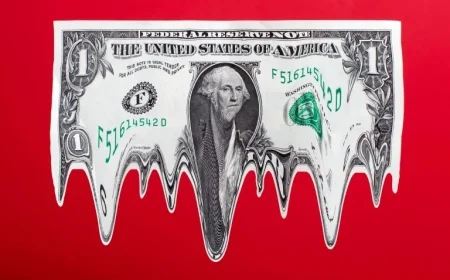

Waymo and Uber Price Gap Narrows

Recent data analysis reveals that the price gap between Waymo’s robotaxis and traditional ride-hailing services, like Uber and Lyft, is decreasing. As per the findings from Obi, a company specializing in ride-hailing data aggregation, Waymo fares are becoming more competitive, particularly in the San Francisco Bay Area.

Waymo vs. Traditional Ride-Hailing Services

Between November 27 and January 1, Obi simulated over 94,000 ride requests. The study showed the average cost of a Waymo ride was $19.69, while Uber rides averaged $17.47, and Lyft rides were even lower at $15.47. This represents a change compared to the previous data released in June, where Waymo rides averaged $20.43, Uber at $15.58, and Lyft at $14.44.

- Waymo Average Cost: $19.69

- Uber Average Cost: $17.47

- Lyt Average Cost: $15.47

Since June, Waymo’s prices dropped by 3.62%, while Uber and Lyft saw increases of 12% and 7%, respectively. Obi CEO Ashwini Anburajan emphasized that consumer willingness to pay a premium for Waymo’s services may be diminishing, impacting the company’s pricing strategy.

The Tesla Factor

A noteworthy element in the analysis is Tesla’s emergence in the robotaxi market, although it is not operating a commercial robotaxi service in San Francisco due to regulatory limitations. Instead, Tesla utilizes a transportation charter permit, deploying employees to drive vehicles that feature its Full Self-Driving software.

The scope of Tesla’s service remains limited, with data indicating approximately 168 vehicles in its ride-hailing fleet. However, the average wait time for Tesla rides was 15.32 minutes, the longest among the surveyed services. In comparison, Waymo was at 5.74 minutes, Uber at 3.15 minutes, and Lyft at 5.14 minutes.

Market Dynamics and Consumer Preferences

Obi’s report also included a survey of 2,000 participants across California, Nevada, Arizona, and Texas regarding their experiences with robotaxis. Of those surveyed, over half reported having taken a ride in a Tesla robotaxi, despite it not functioning at the same scale as Waymo.

- Tesla Preference: 31%

- Waymo Preference: 39.8%

- Zoox Preference: 8%

The preference for Tesla, significantly favored among male respondents, suggests a growing demand for the brand despite its current operational limitations. Looking ahead, Waymo is expanding its services to new cities and entering partnerships with Uber and Lyft.

Future Prospects

Waymo is set to launch a new vehicle in collaboration with Chinese firm Zeekr, aimed at reducing costs and promoting competitive pricing. The year ahead signals potential progress across various autonomous vehicle services, with other companies like Nuro and Motional vying for market share in the robotaxi arena.

This evolving landscape of autonomous vehicles indicates that competition is heating up, as companies race to win over consumers and capture significant market presence.